Inno Laser Technology Sees Share Price Jump, Raising Valuation Questions

Investors in Inno Laser Technology Co., Ltd. (SZSE:301021) have something to celebrate, as the stock price has climbed 27% in the last month, recovering from prior weakness. This recent surge adds to an already impressive performance, with the stock up 95% over the past year.

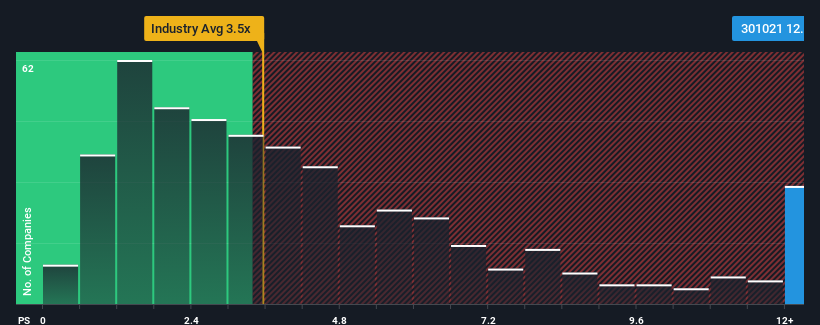

However, following this price increase, the company’s price-to-sales (P/S) ratio stands at 12.6x. This is significantly higher than the industry average, where almost half of the companies in China’s Machinery industry have P/S ratios below 3.5x. This elevated valuation raises questions about whether the stock is overvalued, despite the recent gains.

Recent Performance and Market Expectations

Inno Laser Technology has demonstrated strong recent revenue growth. This performance may be driving investor optimism, with the market potentially anticipating continued outperformance. It’s important to note, though, that these expectations may not align with future realities. Investors should carefully consider whether the current valuation is justified by the company’s fundamentals. Investors can assess the company’s earnings, revenue and cash flow by reviewing the free report.

P/S Ratio and Growth Forecasts

A high P/S ratio like Inno Laser Technology’s is often seen in companies expected to achieve substantial growth, significantly outpacing their industry peers. Over the last year, the company’s revenue increased by a notable 44%. However, revenue growth over the past three years reveals a more mixed picture. The company’s total three-year revenue has barely risen, a detail that contrasts with the high market expectations.

When comparing Inno Laser Technology’s recent performance to the broader industry, the company’s momentum appears weaker. The industry is projected to grow by 23% in the next 12 months, according to recent medium-term annualised revenue results. Seeing slower revenue growth alongside a high P/S ratio is a cause for concern.

The market seems to be focused on potential future improvements in Inno Laser Technology’s prospects, potentially overlooking the less-than-stellar recent growth rates. Given these factors, investors should carefully evaluate the sustainability of the current price levels. If recent revenue trends persist, the share price could eventually suffer.

Implications and Potential Risks

The company’s P/S ratio has increased over the last month, which reflects the share price increase. Generally, the P/S ratio allows for an assessment of market sentiment regarding a company’s health. The fact that Inno Laser Technology currently trades at a higher P/S than its industry peers is an anomaly, given its lower three-year growth compared to the industry’s forecast. When slow revenue growth coincides with an elevated P/S, it increases the risk of a share price decline, which would lower the P/S ratio.

Investors should be aware of potential risks. Analysts have identified warning signs for Inno Laser Technology that should be considered before making any investment decisions. For investors interested in exploring alternative investment opportunities, a list of high-quality stocks is available to provide an overview of other market options.

This article is for informational purposes only and does not constitute financial advice. It is not a recommendation to buy or sell any stock and does not consider individual financial circumstances. Seek professional advice before making investment decisions.