Intel is facing challenging times as its newly launched AI PC chips fail to meet sales expectations, resulting in a production capacity shortage for its older chips. The news comes as the company’s CEO announced impending layoffs and a disappointing financial report that sent Intel’s stock plummeting.

The company’s latest earnings call revealed that customers are opting for less expensive previous-generation Raptor Lake chips instead of the newer, more costly AI PC models like Lunar Lake and Meteor Lake for laptops. Intel’s CFO Michelle Johnston Holthaus explained that customers are seeking to maintain competitive system price points amid economic uncertainties and tariffs.

Production Capacity Shortage

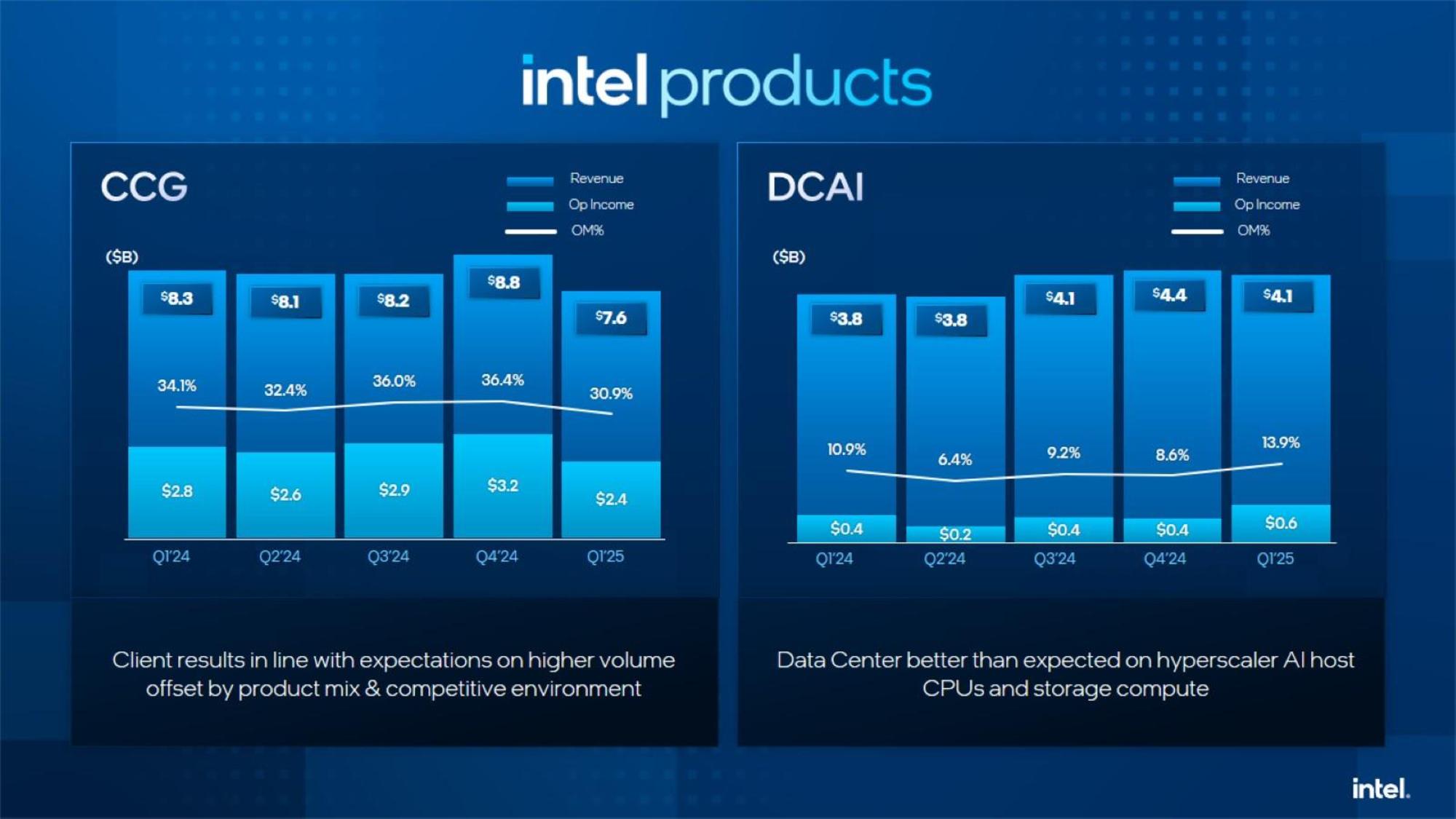

Intel is experiencing a shortage of production capacity for its ‘Intel 7’ process node, which is expected to persist into the foreseeable future. This is unexpected given that Intel’s current-generation chips use newer process nodes from TSMC. The shortage is attributed to an unexpected surge in demand for Intel’s two prior-generation chip families, known as ‘N-1 and N-2’ products, across both consumer and data center markets.

Impact on Future Products

Bernstein Research’s Stacy Rasgon inquired about the implications for Intel’s upcoming Panther Lake chips, set to launch by year-end, particularly with looming tariff disruptions. Holthaus assured that the Panther Lake launch remains on track, with expectations of continued success in the commercial market, which typically precedes broader consumer adoption. However, she didn’t directly address the company’s expectations for next-gen AI PC adoption in consumer laptops.

Market Response and Future Outlook

The lackluster uptake of Intel’s AI PC chips highlights the ongoing challenge of finding a ‘killer app’ that drives consumers to purchase expensive new laptops for AI capabilities. Most new AI features are integrated into existing applications, such as chat and productivity software, which, while valuable, are not flashy enough to spark widespread adoption.

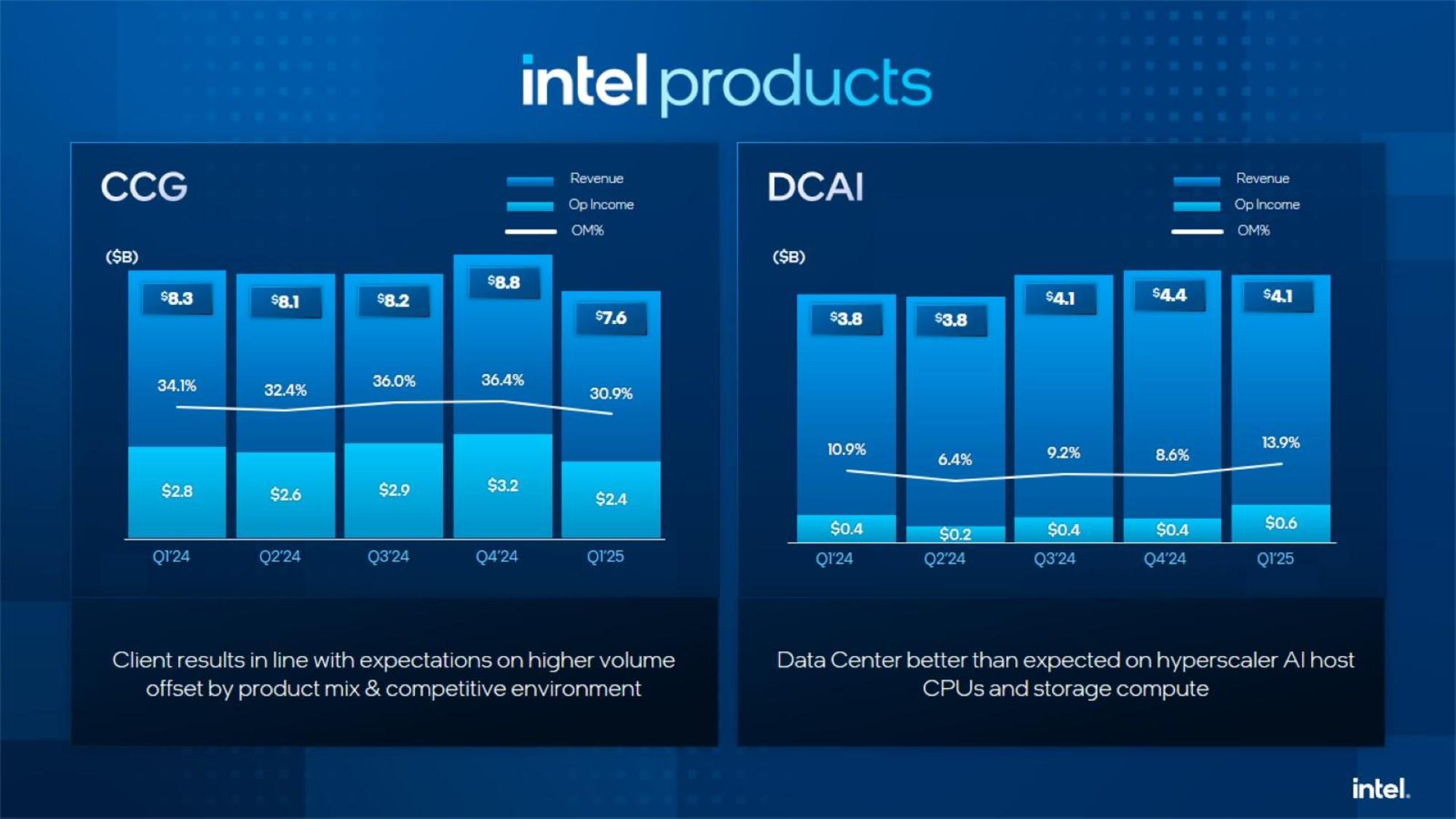

Intel’s Q1 financial results for its Client Computing Group showed an 8% revenue decline compared to the same period last year. The company’s last two chip generations have faced persistent reliability issues, necessitating full chip replacements, which could be contributing to the production capacity constraints due to larger-than-expected returns.

The situation presents an interesting contrast with AMD’s upcoming financial results, scheduled to be revealed in ten days, which may offer additional insights into the CPU market dynamics and potential share losses for Intel.