Intel Eyes a Comeback with Potential AI Partnerships

Intel (INTC), a tech stock that has often trailed its competitors in recent years, is now drawing significant attention. The rise of artificial intelligence (AI) has spurred growth for many tech companies, but Intel, once a computing leader, hasn’t been part of the leading pack.

However, recent developments suggest a potential shift. Last month, INTC saw an increase in value due to rumors of acquisitions of its business divisions. Currently, interest in Intel is growing as leading AI companies consider deals that could revitalize the company.

AI Leaders Show Interest in Intel

As Intel has struggled, other companies have been monitoring the opportunities to grow their reach. Previously, speculation of Broadcom (AVGO) purchasing Intel’s chip design sector caused INTC to rise, while Taiwan Semiconductor Manufacturing Company (TSM) reportedly discussed the acquisition of Intel’s factories.

According to reports, some experts are concerned that a deal with TSMC could harm U.S. AI chip dominance. However, Intel is attracting interest from industry leaders that could lead to substantial purchases.

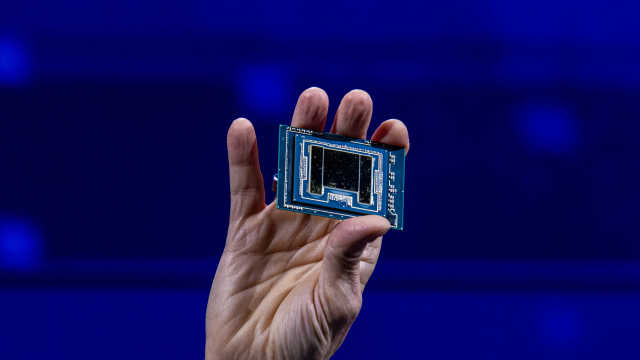

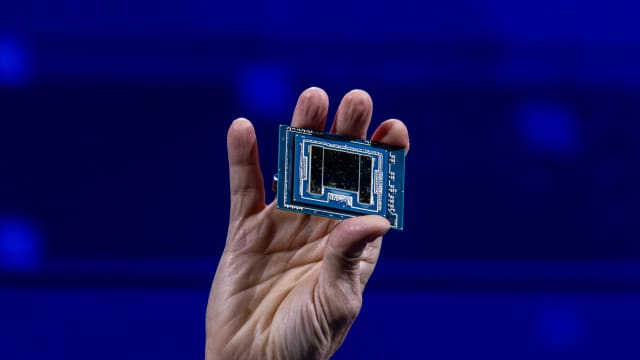

Broadcom and Nvidia (NVDA), the market’s most dominant chip makers, have begun manufacturing evaluations with Intel’s 18A process. This process is a collection of technologies and methods that can create complex and advanced AI processors.

Advanced Micro Devices (AMD) is also evaluating the viability of the 18A manufacturing process to determine if it aligns with their needs. A spokesperson for Intel stated, “We don’t comment on specific customers but continue to see strong interest and engagement on Intel 18A across our ecosystem.”

These tests are evaluating the Intel 18A process and are not using full chip designs. The potential impact of these partnerships on Intel is significant.

Successful testing could bring valuable contracts for Intel as it executes the split of its foundry business, which has hurt its overall valuation. Martin Baccardax from TheStreet reports this could also enhance the worth of any independent chip design company with ties to the new fab business and support from the Chips Act.

If Intel secures a deal with one of the three leading AI companies, it could be the positive catalyst that sets the company on a new course.

However, that development would negatively impact a competitor. Taiwan Semiconductor Manufacturing’s 18A manufacturing process has allowed the company to become dominant in the global AI chip market. TSMC has not released any statements about Intel’s potential deals with Nvidia, Broadcom, or AMD. TSMC’s client list includes all three companies, and it could be the biggest loser of such a deal, no matter which company decides to work with Intel.