If you’re exploring investments in the burgeoning field of quantum computing, you’ve likely encountered names like IonQ, Rigetti Computing, and D-Wave Quantum. While these companies present potential opportunities, their speculative nature makes timing crucial. If the goal is to gain exposure to quantum computing as part of a broader artificial intelligence (AI) portfolio while mitigating risk, the tech giants, often known as the “‘Magnificent Seven,” offer a more stable avenue. Among them, Amazon (AMZN), Microsoft (MSFT), and Alphabet (GOOGL) (GOOG) stand out as compelling choices in the quantum computing revolution.

Investing in Quantum Computing is Harder Than You Think

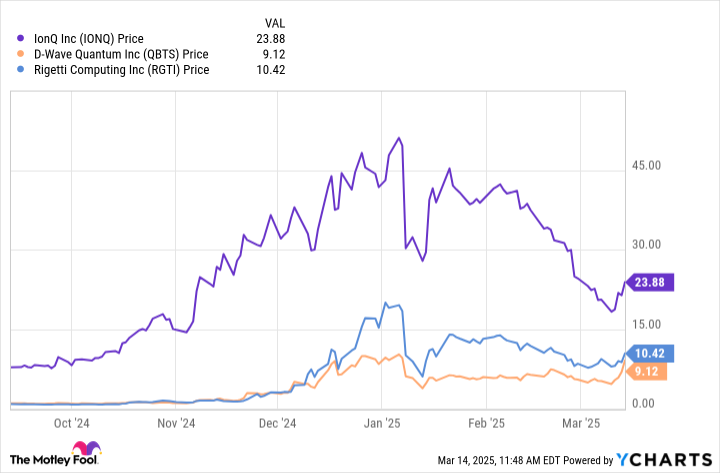

The volatility of some smaller quantum computing stocks highlights the risks. Consider the price action of IonQ, D-Wave Quantum, and Rigetti Computing over the past six months, illustrated in the chart below.

Although these stocks have shown growth, late entrants may face losses. Given that IonQ, D-Wave, and Rigetti have limited revenue and may need further funding, their share prices might not sustain such rapid growth. Generating profits from these speculative stocks often depends on luck. Moreover, Nvidia CEO Jensen Huang estimates that practical, large-scale quantum computing applications are still roughly two decades away. Investing in smaller companies generating little revenue with no clear path to profitability poses significant risks. Instead, investors might consider well-established businesses already generating substantial cash flow, with the resources to invest in emerging fields like quantum computing.

1. Amazon

In classical computing, information is stored as bits, represented by 0s and 1s. Quantum computing uses quantum bits, or qubits, that can exist in multiple states simultaneously. This allows qubits to solve complex problems much faster than even the most advanced supercomputers. However, qubits are highly sensitive to external factors, making error correction a major challenge. Integrating more qubits comes at a high cost. Amazon is aiming to address this. Recently, Amazon announced its new chip, Ocelot, which can reduce the costs of quantum error correction by up to 90%. They’ve achieved this milestone by integrating error correction into its quantum architecture. Amazon believes its “fault-tolerant” computers, developed through the Ocelot architecture, could significantly reduce the costs of quantum computing development.

Amazon’s true value lies in its ability to integrate this service under the Amazon Web Services (AWS) umbrella. AWS is a highly profitable business for Amazon, meaning that this differentiated approach to quantum computing could increase demand for the company’s cloud infrastructure, leading to increased margins and profits once quantum computing becomes more commercially available.

2. Microsoft

A key reason for the sensitivity of qubits is that their base is often composed of basic particles like ions, photons, or electrons. Microsoft’s Majorana 1 quantum chip uses a topological qubit architecture, which the company’s research indicates is more reliable and scalable than traditional qubits because it is less susceptible to external influences. Similar to Amazon, Microsoft seeks to create more efficient quantum applications compared with current options. Microsoft calls its topoconductor a quantum processing unit (QPU), designed to scale to a million qubits per chip. While this is exciting news for quantum computing enthusiasts, investors should know that the Majorana 1 is still a prototype.

3. Alphabet

Google Quantum unveiled its Willow quantum computing chip, which solved a complex benchmark problem in about 5 minutes – a task that would take an advanced classical supercomputer 10 septillion years. While this feat demonstrates Willow’s power, the “random circuit sampling” test is an esoteric exercise. Practical uses for quantum computers, where they provide results superior to today’s supercomputers, are still some time away. Nevertheless, I believe Alphabet’s quantum computing achievements reinforce the idea that today’s most advanced computers will need to be augmented with processing power beyond GPUs as AI applications become more sophisticated, particularly in medicine and financial services. Given Willow’s unique processing capabilities, I am optimistic that Alphabet could be a leader in the quantum landscape.

Think About the Long Run

Amazon, Alphabet, and Microsoft have all built diverse ecosystems, integrating e-commerce, cloud computing, streaming, gaming, software applications, social media, advertising, and consumer electronics. All three recognize the importance of AI in shaping their future, which could lead to accelerated revenue growth and wider profit margins. Quantum computing is still more of a theory within the AI narrative. Nevertheless, quantum computing represents another layer to AI, potentially bundled into these companies’ product suites, increasing diversification and solidifying these businesses as long-term AI revolution winners.