Investors Hesitant on Zhejiang Jiemei Electronic And Technology Co., Ltd. (SZSE:002859)

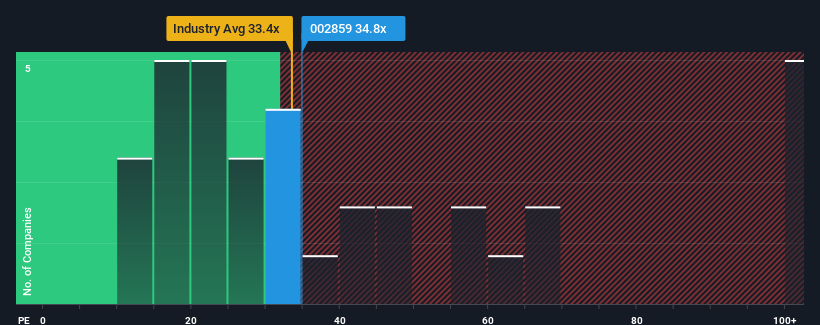

When approximately half of the companies in China have price-to-earnings ratios (P/E) exceeding 40x, Zhejiang Jiemei Electronic And Technology Co., Ltd. (SZSE:002859) might seem like a compelling investment, trading at a P/E of 34.8x. However, a closer examination is needed to understand the reasoning behind this lower P/E.

Recent performance has been positive for Zhejiang Jiemei Electronic And Technology, with earnings growth contrasting with a market downturn. The relatively low P/E could be attributed to investor concerns about a potential decline in the company’s earnings. If these concerns are unfounded, then current shareholders may have reason to be optimistic about future stock price movement.

To gain further insight, a free report about Zhejiang Jiemei Electronic And Technology is available.

What Do Growth Metrics Reveal About the Low P/E?

A lower P/E ratio typically indicates limited growth expectations, and potentially, underperformance relative to the market. While the company demonstrated a substantial earnings increase of 35% in the last year, its earnings per share (EPS) have decreased by 39% over the past three years, which is concerning. This trend likely contributes to shareholder pessimism regarding medium-term earnings growth.

Looking ahead, analysts predict growth of around 42% for the upcoming year. This is notably higher than the broader market’s projected growth of 37%. However, it’s surprising that Zhejiang Jiemei Electronic And Technology’s P/E is below that of most other companies. It seems that some investors have reservations about the forecasts and have been accepting lower selling prices.

The Bottom Line

The price-to-earnings ratio is more effective at summarizing investor sentiment and future expectations, rather than solely functioning as a valuation tool.

Analysis of analyst forecasts for Zhejiang Jiemei Electronic And Technology reveals that the company’s superior earnings outlook isn’t significantly reflected in its P/E. A strong earnings outlook combined with above-market growth typically suggests that potential risks are putting pressure on the P/E ratio. Although price risks appear low, investors seem to be anticipating substantial future earnings volatility.

It’s also worth noting three warning signs associated with Zhejiang Jiemei Electronic And Technology (two of these are somewhat negative), which merit consideration.

For those interested in companies with strong earnings growth and low P/E ratios, a free resource is available.