{ “title”: “Is Alphabet a Buy? Why Now Might Be the Time to Invest”, “description”: “With the recent market correction, Alphabet stock, a key player in AI, looks increasingly appealing. Here’s why now might be the time to consider investing.”, “tags”: “Alphabet, Google, AI, Investing, Tech Stocks, GOOGL, GOOG”, “rewritten_content”: “## Market Correction Creates Potential Opportunity for Alphabet

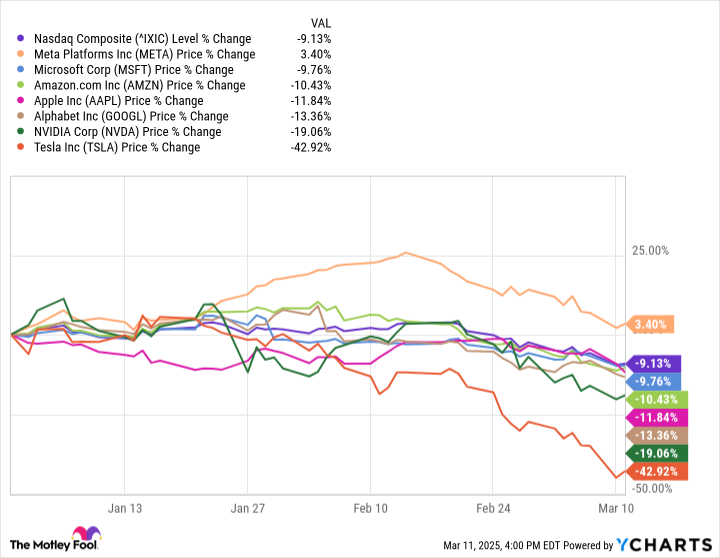

Less than three months ago, the Nasdaq Composite hit an all-time high, continuing a solid run that began two years prior. However, the index has since entered correction mode. As of March 11, it was down over 13% from its peak, including a 9% drop this year. Considering the Nasdaq’s heavy weighting in large tech stocks, it’s no surprise that many prominent names have suffered similar fates.

Of the so-called “Magnificent Seven” tech stocks, Meta Platforms is the only one that has managed to stay in the green so far this year.

Many tech companies focused on artificial intelligence (AI) experienced significant hype over the past couple of years. This same hype (or lack thereof) has now led to some significant drops alongside the overall Nasdaq correction.

This recent market sell-off, however, could represent an increasingly appealing opportunity for investors interested in a specific, often-underrated AI stock: Alphabet (GOOG, GOOGL).

If you have $1,000 to invest, now might be a good time to consider scooping up some shares for the long haul.

Alphabet: A Key Innovator in the AI Space

While many companies have embraced AI-related projects over the past few years, Alphabet has been leading the charge in many AI innovations. A core component of this is DeepMind, Alphabet’s AI research company. It focuses on developing advanced AI models, machine learning algorithms, deep learning frameworks, and reinforcement learning systems.

DeepMind may not get the same level of attention as other Alphabet ventures, but it’s been crucial to Alphabet’s AI advancements, including the development of the Gemini AI model.

Being an early prominent player, with internal AI research and development, gives Alphabet a significant advantage over other big tech companies that are still in the process of building their AI infrastructure or relying on third-party models created by other companies.

In 2024, Alphabet spent $52 billion on capital expenditures, and plans to spend around $75 billion this year. Due to the importance of AI initiatives to its growth, a substantial portion of this capital will, or should, be allocated to those efforts. While more spending doesn’t guarantee success, it demonstrates the company’s willingness to invest heavily in its fastest-growing segment.

Assuming Alphabet does spend $75 billion, this would represent a more than 130% increase from 2023.

Google Cloud Gaining Traction

Cloud computing is a high-growth business for numerous big tech companies, including Alphabet. While its Google Cloud platform trails Amazon Web Services (AWS) and Microsoft Azure in market share, it has doubled its market share over the past seven years to 12%, placing it a distance ahead of fourth-place Alibaba Cloud.

In Q4, Google Cloud generated $12 billion in revenue, up 30% year-over-year. Sundar Pichai, Alphabet’s CEO, noted that the AI-powered Google Cloud platform was experiencing increased customer demand, which is financially validated by its rapid growth.

Google advertising should remain Alphabet’s primary breadwinner for the foreseeable future, but Google Cloud is becoming increasingly important to the company’s overall financial makeup. During Q4, Google Cloud accounted for 12% of Alphabet’s $96.5 billion in revenue, compared to just 5% five years ago.

Long term, Alphabet needs to lessen its dependence on Google Search, which contributed 56% of its Q4 revenue. While Google Search will continue to be a moneymaker for Alphabet, Google Cloud picking up some of the slack is encouraging.

Alphabet Stock: Entering Bargain Territory

A few months ago, Alphabet’s stock was trading at nearly 34 times its earnings. Although it wasn’t as expensive as some other Magnificent Seven stocks, it wasn’t particularly cheap either. After recent drops, Alphabet stock has entered bargain territory, trading at just over 20 times its earnings—significantly cheaper than its recent average.

When you invest in stocks, particularly high-growth tech stocks like Alphabet, some level of risk is inherent. However, there is significantly less risk buying Alphabet at current prices than there was just a couple of months ago.

No one can truly predict if prices will continue to drop. However, if you’re interested in investing in Alphabet, now could be an opportune time to start adding shares. If you’re concerned about further drops, dollar-cost averaging and spreading out your investment can help to offset volatility.