Is Beijing Tongyizhong New Material Technology’s Recent Stock Performance Tethered To Its Strong Fundamentals?

Beijing Tongyizhong New Material Technology Corporation (SHSE:688722) has seen its stock price increase significantly in the last three months, a notable 32% increase. This prompts the question: is this rise supported by the company’s underlying financial health? To answer this, we will delve into the company’s key performance indicators, with a specific focus on Return on Equity (ROE).

Understanding Return on Equity (ROE)

ROE is a crucial metric for investors, illustrating how effectively a company utilizes shareholder capital. It essentially reveals the profit generated by each dollar of investment, showcasing the efficiency of the company’s reinvestment activities.

Calculating ROE

The formula for calculating ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

Based on this, Beijing Tongyizhong New Material Technology’s ROE is calculated as follows:

9.5% = CN¥130m ÷ CN¥1.4b (Based on the trailing twelve months to December 2024).

This means that for every CN¥1 invested by shareholders, the company generated CN¥0.10 in profit.

The Significance of ROE in Earnings Growth

ROE is a measure of a company’s profitability and an indicator of how a company can generate future profits. Companies with high ROE and a high rate of retained earnings frequently demonstrate higher growth rates.

Beijing Tongyizhong New Material Technology’s Earnings Growth and ROE

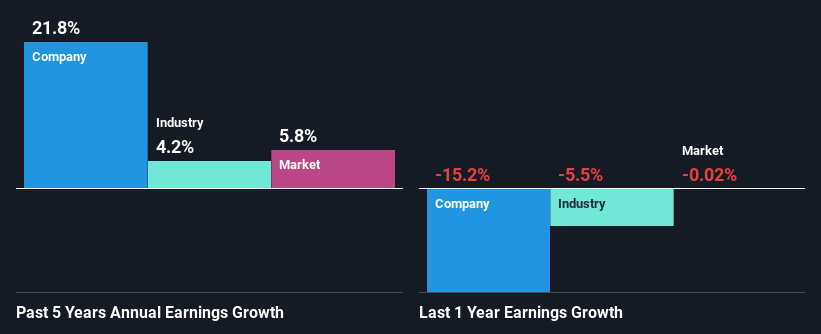

With a ROE of 9.5%, Beijing Tongyizhong New Material Technology’s performance appears to be moderately positive, especially when compared to the industry average of 6.2%. This is even more impressive when considering the company’s 22% net income growth over the past five years. Despite a slightly low ROE, it exceeds the industry average, which could indicate factors driving earnings growth, such as a favorable industry growth phase or a low payout ratio.

Further analysis reveals that Beijing Tongyizhong New Material Technology’s growth surpasses the industry average of 4.2%.

Efficient Use of Retained Earnings

With a three-year median payout ratio of 36%, Beijing Tongyizhong New Material Technology retains 64% of its income, demonstrating efficient reinvestment strategies. This leads to notable earnings growth and a well-covered dividend, particularly as the company only recently started paying dividends, likely to attract investors.

Analysts anticipate the company’s future payout ratio to decrease to 20% in the next three years, which should drive ROE to an estimated 13% during the same period.

Summary

In summary, Beijing Tongyizhong New Material Technology shows a commitment to business reinvestment and a moderate return on investment. This helps explain the impressive earnings growth. Analyst expectations appear to support the continuation of the company’s current growth trajectory, based on both company fundamentals and industry-wide trends.

Disclaimer: This article is for informational purposes only and should not be considered financial advice.