BigBear.ai: An AI Stock Worth Watching?

Artificial intelligence (AI) stocks have recently faced headwinds, mirroring the broader market’s downturn. Investor concerns regarding the economic impact of potential trade actions have contributed to the volatility. Despite these fluctuations, some believe this presents an opportunity to acquire shares of promising companies at more attractive valuations. BigBear.ai (BBAI) is one such company, providing AI solutions to government and commercial clients. But is it a buy?

As of March 12, BigBear.ai’s stock was down approximately 27% year-to-date. This decline could be a buying opportunity, or it could signal caution.

A Rollercoaster Ride for BigBear.ai

While the company’s stock is down in 2025, it experienced a surge in the prior year, gaining approximately 33% through March 12. This boost was fueled by investor interest in AI. The announcement of Project Stargate – a collaborative initiative between Oracle, SoftBank, and OpenAI, which will invest heavily in AI infrastructure – along with a government official’s statements regarding US leadership in AI, contributed to BigBear.ai’s peak of $10.36 per share last month.

However, circumstances changed in March. The broader market pullback contributed, but it wasn’t the sole factor. Following the release of its fourth-quarter earnings report on March 6, the stock price plummeted. Management had projected 2024 revenue between $165 million and $180 million; however, the actual revenue came in at $158.2 million, leading to the stock’s decline.

Reasons to Consider BigBear.ai

Despite falling short of expectations, BigBear.ai’s 2024 revenue still showed growth, increasing from $155.2 million in 2023, thanks to new government contracts. Management anticipates a rise in 2025 sales, forecasting between $160 million and $180 million.

This time around, management bases its optimism on several factors. The company welcomed a new CEO, Kevin McAleenan, in January. The company has strengthened its balance sheet by reducing debt. The company is focusing its AI efforts around four key segments: border security, defense, intelligence, and critical infrastructure.

These areas are key markets that the US and other governments are targeting for AI investment, making them attractive markets to pursue.

Factors Raising Concerns

One primary concern is that BigBear.ai’s revenue relies heavily on federal contracts. Any government spending cuts could significantly impact its sales. The company is currently unprofitable, and its losses have been increasing. In 2024, the net loss totaled $257.1 million, predominantly due to changes in its derivatives portfolio’s value. This is more than four times greater than its 2023 net loss of $60.4 million.

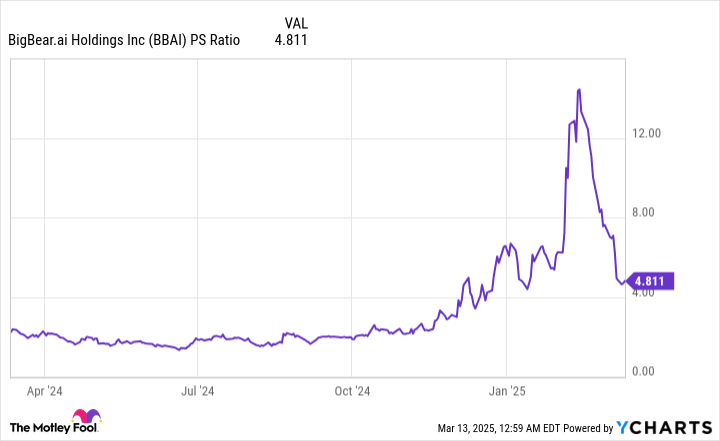

Another factor is the company’s stock valuation. Given its unprofitability, the price-to-sales (P/S) ratio is a useful metric, which measures how much investors are willing to pay for every dollar of a company’s revenue.

Although the recent price drop has made BigBear.ai’s P/S multiple more reasonable, it remains elevated compared to parts of the past year.

Adding to the uncertainty is whether the company can grow its revenues in 2025 amid potential government budget cuts.

Given these considerations, interested investors may want to observe the company’s performance over the next couple of quarters before making a decision.