The Rise of CoreWeave in AI Chip Stocks

The artificial intelligence (AI) chip market has been dominated by names like Nvidia, Broadcom, Advanced Micro Devices, and Taiwan Semiconductor Manufacturing. These companies are at the forefront of designing and manufacturing advanced graphics processing units (GPUs). While semiconductor stocks have generally performed well over the last two years, they’ve experienced a slowdown in 2025 due to uncertainty around tariff negotiations and exposure to China. However, CoreWeave (CRWV 7.48%), which went public in March, has emerged as a new favorite among chip stock investors, with its shares surging 251% as of June 6.

CoreWeave’s Unique Business Model

CoreWeave offers an infrastructure services business that allows customers to access clusters of Nvidia GPUs and other architectures via the cloud. This model provides generative AI developers with an efficient way to access industry-leading hardware without the need for direct purchases, manufacturing wait times, and custom cluster builds. At the end of the first quarter, CoreWeave had $14.7 billion in remaining performance obligations and $11.2 billion in committed contracts from a strategic deal with OpenAI, totaling $25.9 billion in backlog.

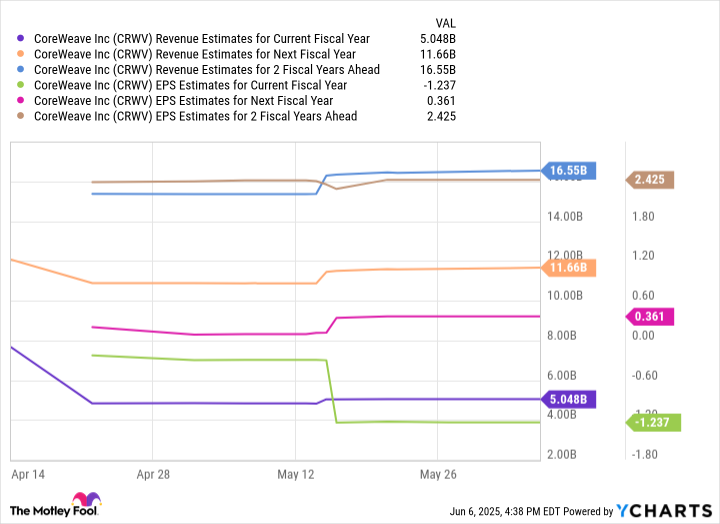

Analysts expect CoreWeave to roughly triple its revenue over the next two years and transition to profitability. However, the company’s valuation suggests that much of this growth is already priced into the stock. CoreWeave’s price-to-sales ratio is significantly higher than that of more mature data center infrastructure businesses like Oracle and Vertiv, and its multiple continues to expand.

Investment Considerations

While CoreWeave’s infrastructure services business is an appealing aspect of the broader AI landscape, its current valuation leaves little room for error. Investing in momentum stocks like CoreWeave can be risky, and buying at record levels requires high conviction that the price will continue to rise. Although CoreWeave may be a long-term winner, there are more reasonable opportunities to buy the stock at a lower price. For now, the stock exhibits characteristics of a meme stock and is best avoided.

Investors should keep an eye on CoreWeave’s performance, as any weakness in its stock price could present a buying opportunity. The company’s unique position in the AI infrastructure market and its growth potential make it a stock worth monitoring, but caution is advised at its current valuation.