DXC Technology Company Analysis

DXC Technology (NYSE:DXC) has seen significant price fluctuations on the NYSE over recent months, ranging from $19.56 to $14.03. Currently trading at $15.20, investors are questioning whether this mid-cap company is undervalued. Our analysis using a price multiple model suggests that DXC Technology is still a bargain, with a price-to-earnings ratio of 7.08x compared to the industry average of 29.02x.

Current Valuation

DXC Technology appears to be trading at a cheaper price relative to its peers. However, its high beta indicates that its price movements will be more volatile than the market average. This could present a buying opportunity during market downturns.

Growth Prospects

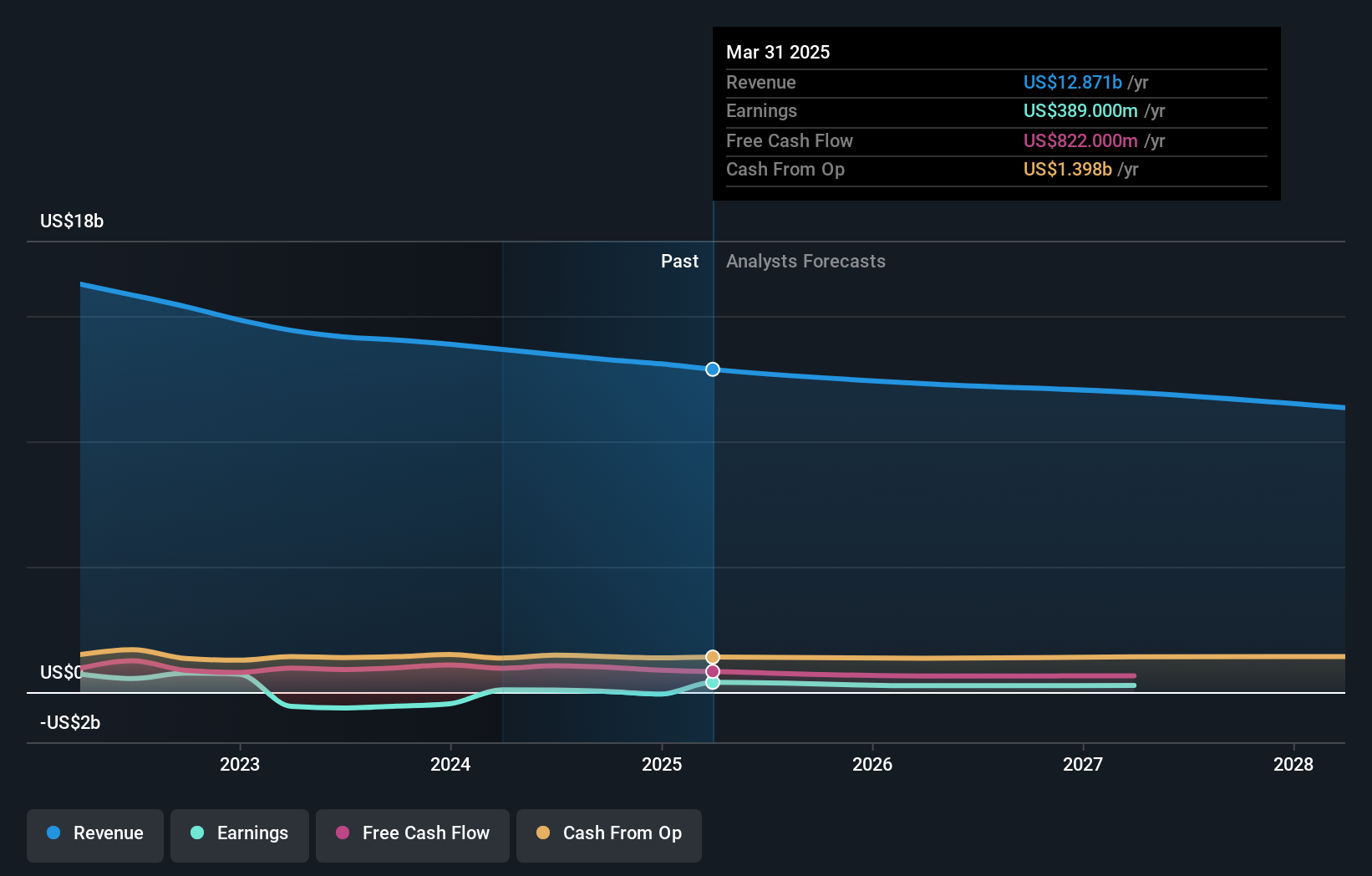

Looking at future expectations, DXC Technology is expected to experience negative earnings growth in the coming years. This presents a risk for potential investors. Despite the current low valuation, the prospect of negative growth is a concern.

What This Means for Investors

For current shareholders, the negative growth prospects may warrant reconsidering portfolio exposure to DXC. For potential investors, now may be a good time to evaluate the stock, but it’s crucial to consider the associated risks.

Risks and Considerations

We’ve identified 3 warning signs for DXC Technology that investors should be aware of before making a decision. It’s essential to weigh these factors when considering an investment in DXC Technology.

In conclusion, while DXC Technology is currently undervalued according to our analysis, its negative growth prospects pose a significant risk. Investors should carefully consider these factors before making an investment decision.