Is DXC Technology Company (NYSE:DXC) a Potential Bargain?

DXC Technology Company (NYSE:DXC) has seen some interesting price movement recently. While not a mega-cap stock, DXC saw its share price fluctuate in recent months, reaching a high of $22.61 and a low of $19.47. This volatility could present opportunities for investors. The key question is whether DXC’s current trading price of around $19.56 reflects its true value.

Let’s delve into DXC Technology’s outlook and valuation based on the latest available financial data to see if there’s a compelling case for investment.

Valuation Overview

Good news for value-oriented investors: DXC Technology appears to be undervalued at present. Our valuation model suggests an intrinsic value of $28.49, which is significantly higher than its current market valuation. This could signal a “buy low” opportunity.

However, DXC’s share price exhibits considerable volatility relative to the broader market (indicated by its high beta). This means that while you might have a chance to buy at a lower price in the future if the price dips, its price can also increase quickly.

Growth Prospects

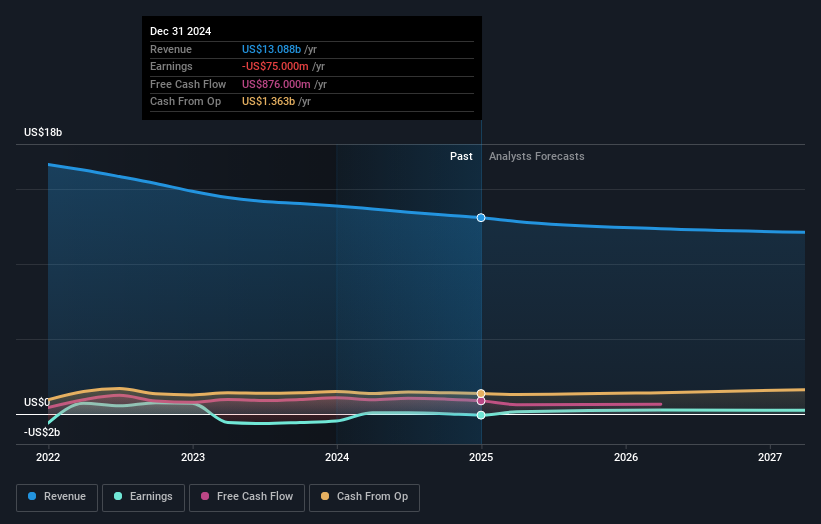

Investors often assess a company’s growth potential before investing. Unfortunately, in DXC Technology’s case, negative revenue growth of -9.1% is projected over the next couple of years. This doesn’t make for a compelling investment thesis.

Therefore, a degree of uncertainty regarding future performance seem warranted, at least in the short term.

What This Means for Investors

For Current Shareholders: While DXC is currently undervalued, the negative growth outlook introduces some uncertainty. It’s essential to consider whether to increase your exposure to DXC or diversify your portfolio to better manage your total risk and return.

For Potential Investors: If you’ve been watching DXC, now may be a critical time to thoroughly research the stock given its current low valuation. But you need to be aware of the risks associated with predicted negative growth. It may be worth checking the latest analyst forecasts for DXC Technology will give you a better picture of how the stock is viewed going forward.

Disclaimer: This analysis is based on publicly available information and a valuation model. It is not financial advice. Investment decisions should be made after consulting with a qualified financial advisor and conducting thorough individual research.