{ “title”: “Is Faraday Technology Corporation (TWSE:3035) a Buy? An Analysis”, “description”: “An assessment of Faraday Technology Corporation (TWSE:3035) stock, examining its valuation and growth potential.”, “tags”: “Faraday Technology, TWSE:3035, stock analysis, semiconductor”, “rewritten_content”: “

Faraday Technology Corporation (TWSE:3035): Investment Considerations

While Faraday Technology Corporation (TWSE:3035) might not be a mega-cap company, it has recently attracted significant investor attention. Over the past few months, the stock has experienced a notable price increase on the Taiwan Stock Exchange (TWSE). However, despite this recent surge, the shares are still below their yearly highs.

Given that many analysts cover the stock, it’s likely that any price-sensitive announcements have already been factored into the current share price. This analysis will examine Faraday Technology’s outlook and valuation to determine if the stock presents a worthwhile opportunity.

Valuation Assessment

Based on a price multiple model that compares Faraday Technology’s price-to-earnings (P/E) ratio to the industry average, the stock appears expensive. The company’s P/E ratio is currently at 58.01x, significantly higher than the industry average of 30.64x. This suggests that the stock is trading at a premium relative to its peers. It’s worth noting that there isn’t sufficient data to forecast the company’s cash flows, so the P/E ratio is the most relevant metric for the valuation.

Investors who are interested in the stock may want to watch for a potential price correction. The stock’s volatility, indicated by its high beta, suggests the price may decline, offering a future buying opportunity.

Growth Potential

For investors looking for companies with high growth potential, consider Faraday Technology’s prospects. While value investors may prioritize intrinsic value, high growth potential at a reasonable price could be a more compelling investment.

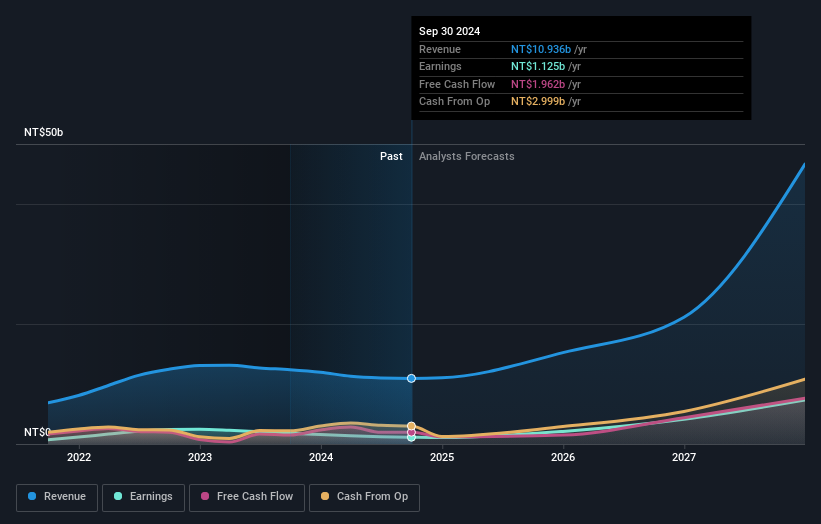

Faraday Technology’s earnings are expected to double in the next few years, signaling a very optimistic future. This anticipated growth should lead to stronger cash flows, which would likely increase the share value. This is a positive sign for investors, but it’s important to remain aware of current valuations to minimize risk.

Investment Implications

For current shareholders, 3035’s positive outlook seems to be reflected in the market, with shares trading above industry price multiples. Shareholders could consider whether to sell and buy back the stock if the price drops toward the industry P/E ratio. However, it’s critical to reassess the fundamentals of the company before such decisions.

Potential investors should understand that the present is likely not the optimal time to invest in the stock because it has surpassed its industry peers. Investors may want to explore other factors to capitalize on the next price drop. Checking analysts’ forecasts could provide valuable insights.

About Faraday Technology Corporation

Faraday Technology Corporation operates as a fabless ASIC/SoC and silicon intellectual property (IP) provider in China, Taiwan, Japan, the United States, and internationally.

Disclaimer: This article is based on historical data and analyst forecasts and is not financial advice.” }