In recent years, Nvidia (NVDA) has become one of the largest companies globally, boasting a market capitalization that currently surpasses $3 trillion. Many other AI stocks have also experienced significant value increases, but is Nvidia stock still a worthwhile investment? According to new research from The Motley Fool regarding AI adoption rates, the answer appears to be a strong yes. The statistics highlighted in the report may surprise many.

The AI Revolution: Just Getting Started

While the AI craze is evident, the revolution is just beginning. This is a long-term process, offering considerable opportunities for early investors who remain patient. Consider some adoption statistics compiled by The Fool in its recent report:

- The current AI adoption rate for U.S. businesses stands at only 6.8%.

- However, the projected usage rate over the next six months is 9.3%.

This signifies a 37% increase in just six months! Even after this expected growth, total AI adoption will remain under 10%.

“Those numbers might appear low given how AI is often discussed as a game changer for businesses,” the report mentioned. This highlights the point that, despite the extensive discussions around artificial intelligence currently, its actual adoption remains quite limited. Rapid growth should change that story quickly, but this will take many years, if not decades, to fully unfold. The Fool isn’t alone in its findings.

The Long-Term Growth of AI

According to global consultancy McKinsey, the AI market is projected to experience tremendous growth by 2040. The firm’s low-end estimate projects AI software and services revenue to jump from $85 billion in 2022 to $1.5 trillion in 2040. On the higher end, the industry’s revenue could reach $4.6 trillion!

Focusing specifically on generative AI, McKinsey anticipates $2.6 trillion to $4.4 trillion in added economic growth, resulting from business adoption of the technology. This represents a growth opportunity of historical proportions. But does this mean that a stock like Nvidia is a buy right now? The answer may surprise you.

Is It Time to Invest in Nvidia?

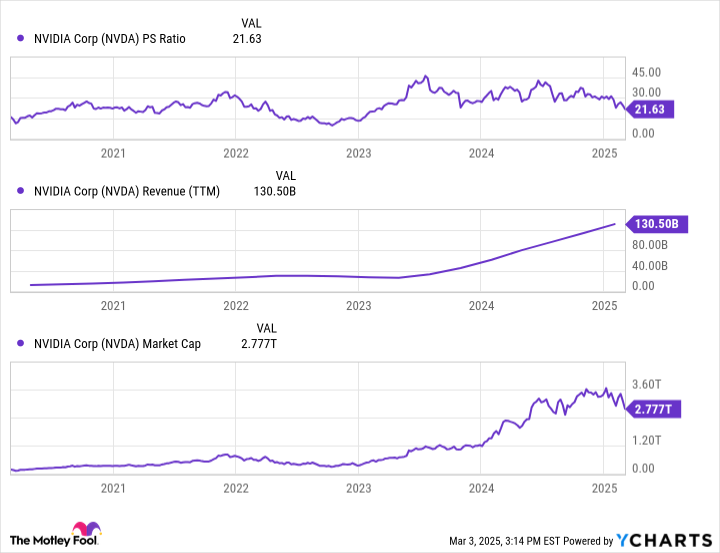

Identifying a growth market differs from investing in one. Stocks with high potential are priced accordingly, so even with an impressive growth rate, its valuation may offset most of that growth. Nvidia is currently in an interesting position. For a multi-trillion-dollar company, its price-to-sales multiple (P/S) is surprisingly high at 21.6. However, its revenue growth trajectory is clearly robust, and considering the statistics discussed above, Nvidia is likely to continue this growth for years to come.

Growth stocks such as Nvidia are typically volatile in the short term. Earlier this year, the stock experienced a correction, resulting in hundreds of billions of dollars being shaved off its market cap. A sudden rebound is equally possible. However, investors seeking to capitalize on the increasing AI adoption rates shouldn’t be overly concerned with short-term volatility.

Nvidia’s dominance in AI graphic processing units – driven by early investments, strategic decisions like the 2006 launch of its CUDA developer suite, and a focus on controlling both the software and hardware ends of the supply chain – positions the company to thrive in a rapidly expanding market for many years. Over extended periods, even premium multiples can appear cheap in retrospect. Nvidia remains a strong pick for investors looking to profit from the AI revolution.