Is Supcon Technology’s Recent Stock Performance Tethered To Its Strong Fundamentals?

Supcon Technology Co., Ltd. (SHSE:688777) has seen a significant 33% increase in its stock price over the past three months. Given that the market often rewards companies with robust financial performance, it’s worth investigating whether this recent surge is justified. This analysis will focus on Supcon Technology’s Return on Equity (ROE) to assess its underlying financial strength.

Understanding Return on Equity (ROE)

Return on Equity (ROE) is a key metric used to evaluate how effectively a company’s management utilizes shareholder investments to generate profits. In essence, it reveals the company’s ability to convert investments into earnings.

Calculating ROE:

The formula for calculating ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

Based on the provided data, the ROE for Supcon Technology is:

11% = CN¥1.1b ÷ CN¥10b (Based on the trailing twelve months to September 2024).

This means that for every CN¥1 of equity, the company generated CN¥0.11 in profit.

ROE and Earnings Growth

The ROE serves as an indicator of a company’s profitability. The rate at which a company chooses to reinvest and retain its profits is a major factor in evaluating its future profit-generating capacity. Companies with high ROE and high levels of profit retention generally exhibit greater growth rates compared to companies that don’t necessarily share these characteristics.

Supcon TechnologyLtd’s ROE

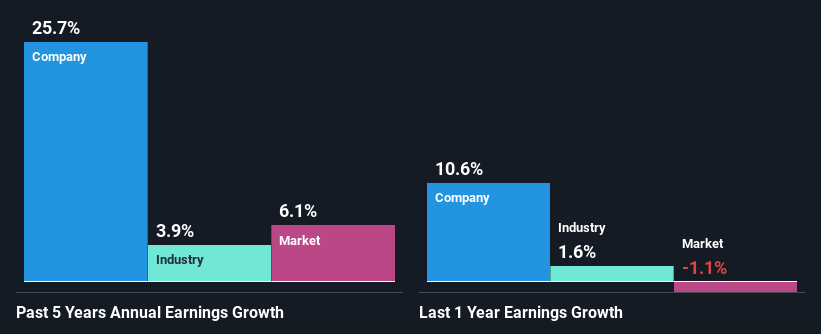

Supcon Technology Ltd seems to have a respectable ROE of 11%, especially when compared to the average industry ROE of 6.2%. This impressive ROE aligns with Supcon Technology’s exceptional 26% net income growth over the past five years. This growth may be attributed to strategic decisions by the company’s management or a low payout ratio.

Furthermore, the company’s net income growth surpasses the industry average of 3.9%.

Effectiveness of Retained Earnings

Supcon Technology has a three-year median payout ratio of 39%, retaining roughly 61% of its income. This suggests the company is reinvesting efficiently, leading to significant earnings growth while also paying dividends. The company has a four-year history of paying dividends, demonstrating a commitment to sharing profits with shareholders. Analysts anticipate the payout ratio to remain steady at 42% over the next three years, while the ROE is predicted to rise to 14%.

Conclusion

Supcon Technology’s performance appears strong, particularly in its high rate of return on reinvestment. This has led to compelling earnings growth. However, the latest analyst forecasts suggest a possible slowdown in future earnings growth.