Analyzing Synnex Technology International’s Financial Strength

This article provides an analysis of Synnex Technology International Corporation (TWSE:2347), focusing on Return on Equity (ROE) as a key indicator of financial performance. While experienced investors are familiar with financial metrics, this analysis aims to explain ROE and its significance for those less acquainted with the concept.

The primary goal is to assess the profitability and efficiency of Synnex Technology International in managing its investors’ capital. ROE helps us understand how effectively the company is growing its value. It allows us to determine the amount of profit a company generates relative to its shareholders’ equity.

Calculating Return on Equity

ROE can be calculated using the following formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

Based on the latest available data (trailing twelve months to September 2024), the ROE for Synnex Technology International is:

12% = NT$9.1b ÷ NT$77b

This indicates that for every NT$1 of shareholder equity, the company generated NT$0.12 in profit over the specified period.

Evaluating Synnex Technology International’s ROE

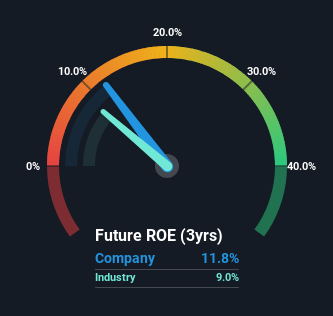

To gauge the quality of a company’s ROE, a comparison with its industry average is useful, although it’s necessary to remember that companies within the same industry can differ significantly. Synnex Technology International shows a superior ROE compared to the average (9.0%) in the Electronic industry. This is a positive sign.

However, a high ROE isn’t a guarantee of exceptional financial performance. A high proportion of debt in a company’s capital structure can also lead to a high ROE. Large debt levels can, however, pose significant risks.

Debt’s Impact on ROE

Companies usually need to invest capital to boost their profits. Investment capital comes from prior year profits (retained earnings), by issuing new shares, or through borrowing. While the first two options show the use of cash for growth in ROE, debt required for growth boosts returns, which will not impact the shareholders’ equity. The use of debt will thus inflate ROE, even if the core business economics stay the same.

Debt and Synnex Technology International’s ROE

Synnex Technology International clearly employs a high amount of debt to enhance returns, as evidenced by its debt-to-equity ratio of 1.12. Although the ROE is decent, it’s necessary to recognize that the high debt level is a factor to consider. Investors are encouraged to consider how a company would perform if it were to experience difficulty in accessing credit, as credit markets are subject to change over time.

Conclusion

ROE offers a valuable tool for comparing the business quality of different companies. It is a good sign when a company can achieve a high return on equity without relying on debt. If two companies have roughly the same level of debt to equity, the one with the higher ROE is generally preferable. It’s important, conversely, to consider the market’s valuation of a high-quality business and the anticipated profit growth relative to the expectations reflected in the current price.

For further insights, it is advisable to access the FREE visualization of analyst forecasts for the company, available online. Investors should be aware that Synnex Technology International may not be the best stock to buy and should check a freely available list of interesting companies with high ROE and low debt before making any decisions.