Is Shanghai Wisdom Information Technology’s Stock Downturn a Worrying Sign?

Recent market activity has seen Shanghai Wisdom Information Technology Co., Ltd. (SZSE:301315) experience a 10% drop in its stock value over the past week. While this might prompt concern, it’s essential to remember that long-term stock performance is largely driven by a company’s underlying financial health. This analysis delves into the key financial indicators of Shanghai Wisdom Information Technology to determine whether the current dip is justified or presents an opportunity.

Return on Equity (ROE): A Key Indicator

Return on Equity (ROE) is a crucial metric for investors as it showcases how efficiently a company utilizes shareholder investments. In essence, it reveals the profitability of a company in relation to its shareholders’ equity. A higher ROE typically indicates better performance.

Calculating ROE

The ROE is determined using the following formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

Based on the trailing twelve months ending September 2024, Shanghai Wisdom Information Technology’s ROE is calculated as:

6.2% = CN¥62m ÷ CN¥1.0b

This implies that for every CN¥1 invested by shareholders, the company generated a profit of CN¥0.06.

ROE and Earnings Growth

ROE provides insight into a company’s capacity for future earnings. The rate at which a company reinvests or “retains” its profits gives us clues about its potential to generate additional profits. Generally, a higher ROE combined with a high-profit retention rate signifies a stronger potential for the company’s growth compared to others that lack these features.

Shanghai Wisdom Information Technology’s ROE and Earnings Performance

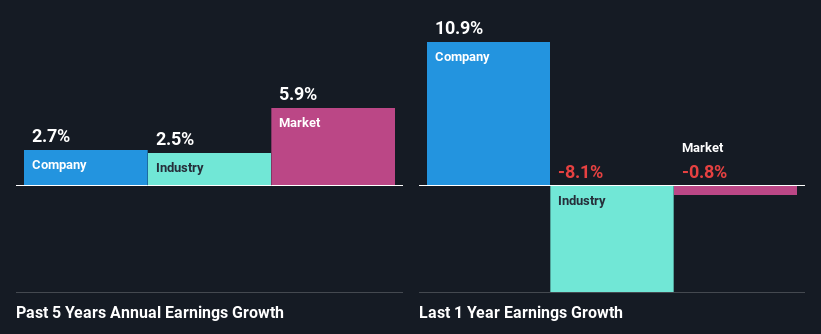

Initially, Shanghai Wisdom Information Technology’s ROE of 6.2% may appear modest. However, this figure surpasses the industry average ROE of 4.6%, which is noteworthy. Despite this, the company has shown a measured earnings growth of 2.7% over the last five years. This could be related to other factors affecting earnings.

Moreover, the company’s net income growth aligns closely with the industry average growth rate of 2.5% during the same period. A key factor to also consider moving forward will be comparing expected earnings growth to the share price to determine whether the stock is undervalued or overvalued.

Efficiency of Profit Utilization

Despite a typical three-year median payout ratio of 42% (corresponding to a retention ratio of 58%), Shanghai Wisdom Information Technology has shown minimal earnings growth. This might suggest other factors are at play, potentially hindering growth. The company recently initiated dividend payments, implying management’s preference for dividends.

Summary

In conclusion, Shanghai Wisdom Information Technology presents some positive aspects for investors. Notably, the significant investment into its business, along with a moderate rate of return, has contributed to its earnings growth. Assessing the company’s risk profile is recommended for making an informed investment decision. This analysis does not constitute financial advice.