Is Walsin Technology’s (TWSE:2492) Recent Performance a Cause for Concern?

Walsin Technology’s (TWSE:2492) recent stock performance, with a 4.0% decline over the past week, might raise eyebrows. Given that long-term stock prices typically reflect a company’s underlying financial health, it’s worthwhile to examine key indicators. This analysis will focus on Walsin Technology’s Return on Equity (ROE) to assess its profitability and efficiency.

Understanding Return on Equity (ROE)

ROE is a crucial metric for investors, as it reveals how effectively a company is using shareholder capital. It essentially measures a company’s profitability relative to its equity. The higher the ROE, the better a company is at generating profits from the money shareholders have invested.

How is ROE Calculated?

The ROE formula is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

Based on the trailing twelve months ending September 2024, Walsin Technology’s ROE is 4.3%, calculated as NT$2.5 billion in net profit divided by NT$59 billion in shareholders’ equity. This means that for every NT$1 of equity, the company generated NT$0.04 in profit.

The Significance of ROE and Earnings Growth

ROE indicates how well a company converts investments into profits. A company’s ability to reinvest profits, or its “retention” rate, significantly impacts its future earnings potential. Generally, companies with both high ROE and high profit retention tend to achieve higher growth rates.

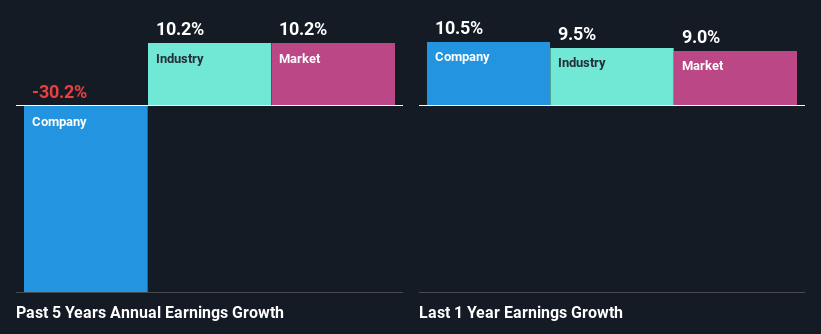

Walsin Technology’s ROE and Declining Earnings

Walsin Technology’s ROE of 4.3% appears modest. Compared to the industry average ROE of 8.9%, the company’s performance seems even less encouraging. Furthermore, the significant 30% decline in net income over the past five years raises concerns. Potential factors impacting earnings include low earnings retention and possibly, inefficient capital allocation.

Despite the industry showing a 10% earnings growth over the same period, Walsin Technology’s earnings have shrunk. This raises a red flag.

Evaluating Earnings Growth

Examining earnings growth is crucial when valuing a stock. Investors should assess whether the market has accurately priced in the anticipated earnings trends, whether they are positive or negative. This assessment helps determine the company’s potential future prospects.

Is Walsin Technology Using Its Retained Earnings Effectively?

With a high three-year median payout ratio of 53%, a significant portion of Walsin Technology’s profits are distributed to shareholders. Only a small portion is reinvested in the business, which helps explain the company’s stagnant earnings. This implies limited opportunities for earnings growth.

Conclusion

Investors should carefully consider any investment decisions concerning Walsin Technology. The low ROE, coupled with limited reinvestment in the business, has led to disappointing earnings growth. For a more in-depth understanding of Walsin Technology’s financial performance, further analysis of past earnings, revenue, and cash flow is recommended.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.