Workday (WDAY) is trying to reignite its stock price, which is trading slightly below where it ended 2021. The software-as-a-service (SaaS) company got a boost following its fourth-quarter reports and guidance, particularly as it leans into artificial intelligence (AI) to drive growth. While shares have improved recently, the financial and human capital management software company is still down more than 10% year-over-year, as of this writing. Let’s examine the Q4 results and the company’s guidance to determine if the stock is a worthwhile investment right now.

Expanding Operating Margins

For the fiscal year 2025 fourth quarter, which ended January 31, Workday’s results exceeded analyst forecasts. Revenue increased 15% year over year, reaching $2.21 billion, with subscription revenue jumping 16% to $2.04 billion. This slightly exceeded the $2.025 billion in subscription revenue that Workday had projected. Total revenue also surpassed the $2.18 billion analyst consensus, as compiled by LSEG. Adjusted earnings per share (EPS) also climbed 22% to $1.92, well above the $1.78 consensus.

AI continues to be a major driver in its revenue growth. Roughly 30% of customer expansions included at least one AI product. The company noted that its Extend Pro product, which allows customers to build AI applications on top of its platform, remains one of its fastest-growing products, with annual contract value (ACV) more than doubling sequentially. The Recruiting Agent AI solution also saw its ACV nearly double quarter over quarter.

Workday added several major customers during the quarter and now has 11,000 customers across various industries and geographies. The company also reports that it serves over 60% of the Fortune 500 companies and 30% of the Global 2000.

Partnerships are similarly contributing to growth, with 15% of its new quarterly ACV arising through this channel. Workday’s 12-month subscription revenue backlog increased by 15% to $7.63 billion, and its total subscription revenue backlog rose 20% to $25.06 billion. Both figures suggest potential future revenue growth.

The company remains a cash flow machine, producing operating cash flow of $2.46 billion and free cash flow of $2.19 billion for fiscal 2025. It concluded the fiscal year with $8 billion in cash and marketable securities and approximately $3 billion in debt. During the year, it bought back 2.9 million shares at a cost of $700 million. These buybacks are primarily intended to offset shareholder dilution from stock-based compensation.

Looking forward, the company forecasts fiscal year 2026’s subscription revenue to increase by 14% to $8.8 billion. It is targeting an adjusted operating margin of around 28%, a substantial increase from the 25.9% adjusted operating margin in fiscal 2025. The revenue guidance was unchanged from earlier expectations, and the adjusted operating margin was up from the previous guidance of 27.5%.

For the first fiscal quarter, Workday expects subscription revenue to rise by 13% to $2.05 billion and an adjusted operating margin of approximately 28%. The company noted that, unlike some competitors that rushed to monetize their AI offerings, it initially integrated these features into its core offerings. Now that its AI solutions are demonstrating a solid return on investment (ROI), Workday intends to explore new monetization opportunities with them. Recently, it launched four new AI agents for contracts, payroll, financial auditing, and policy. These are non-task agents, meaning that each agent features multiple skills to aid individuals in their roles, unlike most agents currently in the market.

Is it Time to Invest in Workday?

Workday is no longer the high-growth stock it was before the pandemic, when its revenue growth often exceeded 30%. However, the company has settled into a solid mid-teens revenue growth rate and is beginning to realize strong operating leverage, as seen in the significant increase in adjusted operating margins planned for fiscal 2026. This improved operating leverage suggests that earnings should grow much faster than revenue, making it an attractive business at the right valuation.

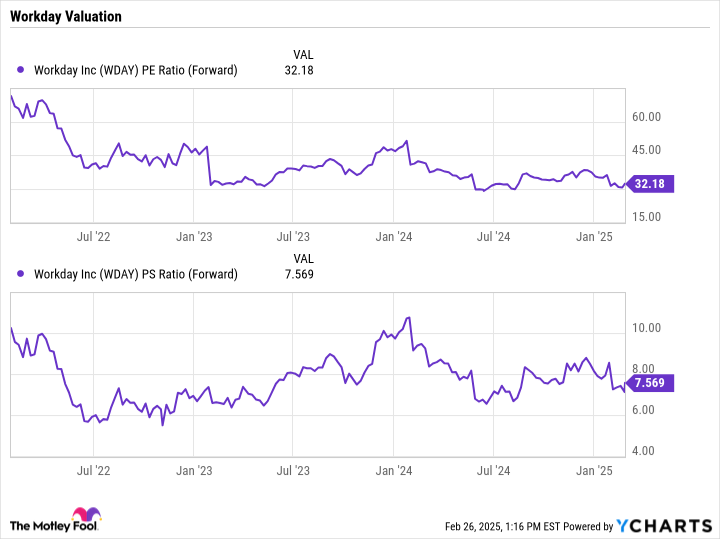

Currently, the company has a forward price-to-sales (P/S) ratio of 7.6 and a forward price-to-earnings (P/E) ratio of just over 32, according to analysts’ estimates for fiscal 2026. This valuation appears reasonable within the current market context, particularly for a stock like Workday with its high-margin, predictable SaaS model. The company is experiencing strong adoption of its new AI solutions, which should drive revenue growth and operating margin expansion. The combination of AI-driven revenue growth and expanding operating margins makes Workday stock a buy in the author’s view.