Yinchuan Weili Transmission Technology: A Closer Look at the Recent Surge

Yinchuan Weili Transmission Technology Co., Ltd. (SZSE:300904) has recently experienced a significant surge in its stock price, gaining 30% over the past month. This follows a period of volatility, and even with the recent increase, the company’s shares are up 14% for the year.

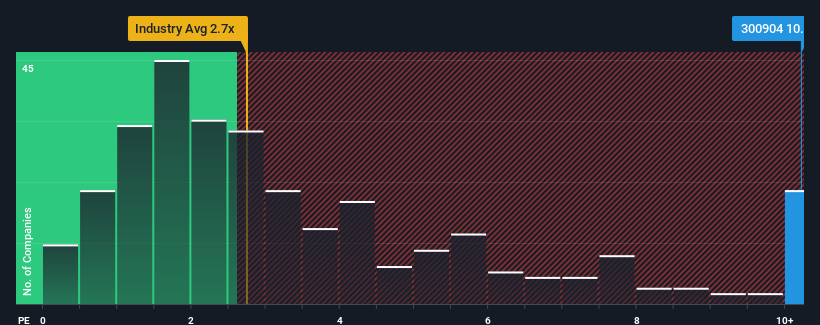

Given this impressive performance, investors might be tempted to view Yinchuan Weili Transmission Technology’s current price-to-sales (P/S) ratio of 10.2x with caution, especially considering that almost half the companies in China’s Electrical industry have P/S ratios below 2.7x. However, a deeper investigation is needed to determine the rationality behind this high P/S ratio.

Assessing the P/S Ratio

One crucial factor to consider is the company’s financial performance. Revenue has been declining, suggesting a potentially weak financial performance. The market may believe the company will outperform the industry soon, supporting a high P/S ratio. If this expectation doesn’t materialize, the stock’s viability could be in danger.

Want to understand the earnings, revenue and cash flow in more detail? You can access a free report on Yinchuan Weili Transmission Technology [here](insert link).

Revenue Forecasts and P/S Justification

To justify its high P/S ratio, Yinchuan Weili Transmission Technology would need to exhibit growth significantly exceeding the industry average. Unfortunately, the company’s top line decreased by 24% over the past year. Furthermore, the last three years show a concerning trend, with revenue shrinking by 34% in total. In contrast, the industry is projected to grow by 27% in the next 12 months, and despite the recent price increase the company’s declining performance suggests existing shareholders could face disappointment if the P/S ratio falls.

Given the company’s underperformance relative to industry forecasts, this makes this high valuation even more concerning.

What the P/S Means for Investors

Recent upward movement in Yinchuan Weili Transmission Technology stock has contributed to its high P/S figure. While the P/S ratio shouldn’t be the only factor in investment decisions, it can serve as a useful metric of revenue expectations. In this instance, the analysis indicates shrinking revenue alongside industry growth projections. If the company continues to underperform, and investors do not adjust their predictions, the share price could decline.

Ultimately, current trends could put shareholder investments at significant risk. The stock analysis reveals three warning signs that investors should be aware of. You can explore a list of companies with solid fundamentals [here](insert link).

Disclaimer: This article is for informational purposes only and should not be considered financial advice.