JA Solar Technology: Private Companies Reap Rewards

Private companies hold the lion’s share of JA Solar Technology Co., Ltd. (SZSE:002459), a major player in the Chinese semiconductor industry. This significant ownership stake meant that these entities were the primary beneficiaries of the company’s recent market capitalization increase.

According to data current as of February 28, 2025, private companies control 51% of JA Solar’s stock. This strong position suggests that the decisions made by these shareholders have a substantial influence on the company’s direction. The recent 5.6% rise in market cap translated into a CN¥2.3 billion increase in value for the company, with private companies gaining the most.

The ownership structure of JA Solar also includes institutional investors and the general public. Institutions hold an 11% stake, indicating a degree of credibility within the investment community. However, the article cautions against solely relying on institutional backing, as these investors are sometimes mistaken. The general public, comprising individual investors, owns 37% of the company.

Notably, hedge funds do not appear to have a meaningful investment in JA Solar Technology. The largest shareholder is Ningjin Jingtaifu Technology Co., Ltd., with 48% of outstanding shares. Other significant shareholders include GF Fund Management Co., Ltd. (2.6%) and Nanjing Zhoubo Fangwei Enterprise Management Center (Limited Partnership) (approximately 1.6%).

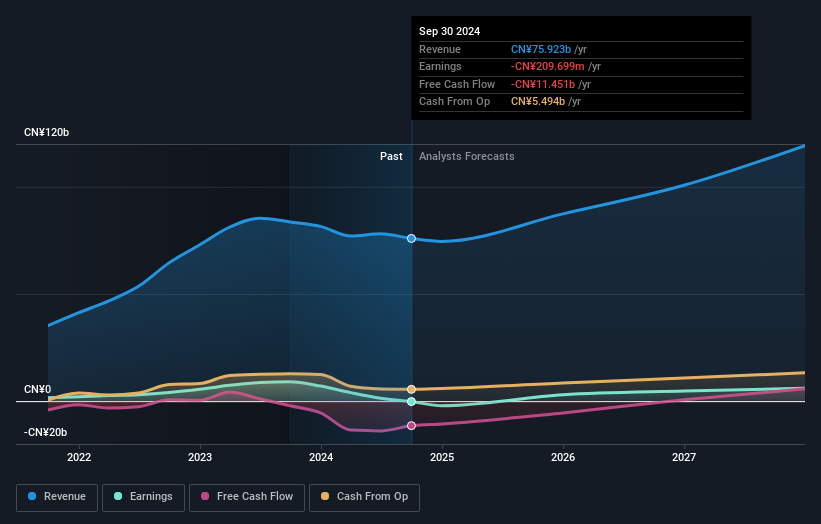

Considering the perspectives of financial analysts is also important. Several analysts cover the stock, making it relatively easy to review growth forecasts.

Insider Ownership

Insiders, including board members, hold less than 1% of the company’s shares, which is approximately CN¥69 million at current prices. Even with their modest direct ownership, insiders are key to the company’s leadership, and their decisions are often aligned with how the business is managed. One should examine their recent buying and selling of shares to further assess their perspectives on the business.

Conclusion

While this analysis provides information about shareholder control, it’s essential to consider other factors for a full investment picture. Investors should be aware that the company has some warning signs. Furthermore, analyst forecasts for future performance should be considered to determine the potential for company growth.

Note: Figures are calculated using data from the last twelve months.