Jiangxi Xinyu Guoke Technology Stock: A Closer Look

It’s hard to ignore the recent dip in Jiangxi Xinyu Guoke Technology’s (SZSE:300722) stock price; a decrease of 11% over the past three months might make investors hesitant. However, a deeper dive into the company’s financial standing suggests a more optimistic outlook. Given the significant role that financial fundamentals play in long-term market trends, it’s essential to examine this company’s performance.

This analysis will focus on Jiangxi Xinyu Guoke Technology’s Return on Equity (ROE), a key metric for assessing the efficiency with which a company uses shareholder capital.

Understanding Return on Equity (ROE)

Return on equity (ROE) is a critical financial ratio that measures a company’s ability to generate profit relative to its shareholders’ equity. It indicates how effectively a company’s management utilizes the capital invested by shareholders. In simple terms, it assesses the profitability of a company in relation to its equity capital.

Calculating ROE

ROE is calculated using the following formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

Based on the trailing twelve months ending September 2024, the ROE for Jiangxi Xinyu Guoke Technology is:

13% = CN¥78m ÷ CN¥619m.

This means that for every CN¥1 invested by shareholders, the company generated a profit of CN¥0.13.

ROE and Earnings Growth: What’s the Connection?

ROE offers insight into a company’s potential for future earnings. By analyzing how the company reinvests or ‘retains’ these profits, and how efficiently it does so, we can assess the potential for earnings growth.

Generally, companies with a higher ROE and a higher profit retention rate tend to experience higher growth rates compared to those without these characteristics.

Jiangxi Xinyu Guoke Technology’s Earnings Growth

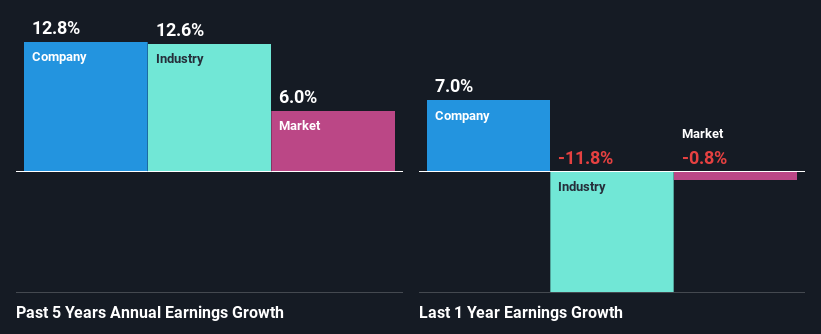

Jiangxi Xinyu Guoke Technology’s ROE of 13% appears respectable, particularly when contrasted with the industry average of 5.7%. This is likely reflected in the company’s solid 13% net income growth over the past five years.

Comparing Jiangxi Xinyu Guoke Technology’s net income growth with the industry average shows that the company has reported growth that is in line with the industry average growth rate of 11% over the last few years.

Earnings growth is a vital factor when assessing a stock’s value. Investors also need to determine if expected earnings growth is already reflected in the share price.

One useful indicator for determining the expected earnings growth is the P/E ratio, which indicates the price the market is willing to pay for a stock based on its earnings potential. Investors should consider if Jiangxi Xinyu Guoke Technology is trading at a high or low P/E relative to its industry peers.

Reinvesting Profits Effectively

Jiangxi Xinyu Guoke Technology shows a healthy combination of a median three-year payout ratio of 44% (or a retention ratio of 56%) and strong earnings growth, indicating the company effectively utilizes its profits. Additionally, the company’s consistent dividend payments over seven years highlight its commitment to sharing profits with shareholders.

Summary

Overall, Jiangxi Xinyu Guoke Technology’s performance has been quite strong. Its ability to reinvest a large portion of its earnings with a significant return is noteworthy. This has, in turn, led to substantial growth in its earnings. Investors may want to do further research based on their own investment strategies before making a decision.