JPMorgan’s latest eTrading survey, which polled over 4,200 institutional traders, offers insights into the evolving landscape of cryptocurrency trading. While the majority of respondents still express a lack of interest in the asset class, the survey signals some positive developments.

The survey indicates that 71% of institutional traders have no plans to trade cryptocurrencies, a decrease from 78% the previous year. The proportion of active traders saw a rise, climbing to 13% from 9% in 2024. This increase in active trading activity is likely linked to the introduction of U.S. Bitcoin ETFs in January 2024, and the concurrent surge in cryptocurrency prices. Bitcoin, in particular, experienced a significant appreciation, with its value increasing by over 120% between the start and end of 2024, a marked comparison to the post-FTX recovery period of 2023.

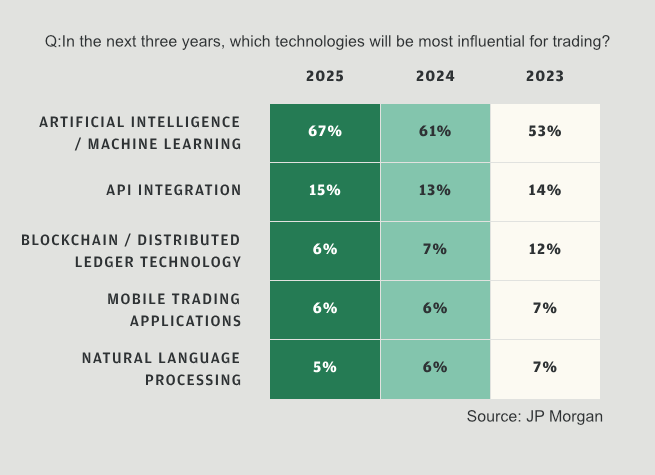

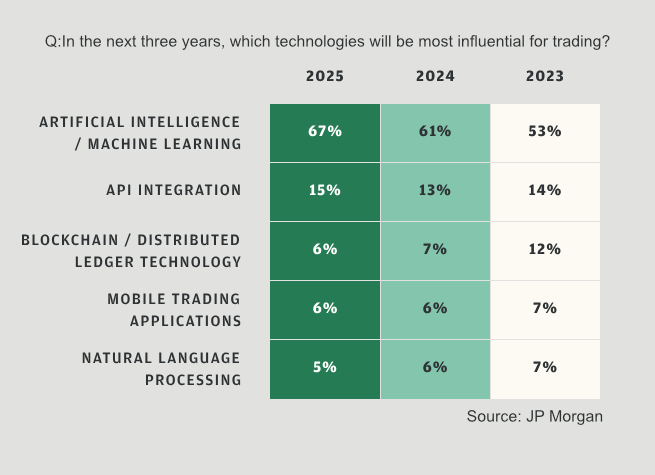

The survey also asked about the technologies deemed most important. Artificial intelligence maintained its dominant position. APIs followed closely, while blockchain ranked a distant third, selected by only 6% of respondents, a slight decrease from 7% the prior year.

While tokenization is expected to generate greater interest in blockchain technology, its primary effect on the trading of conventional securities has been in the back office, rather than impacting traders directly. Many tokenized bonds, for instance, are traded conventionally, even though their settlement occurs on a blockchain. Large digital securities platforms are increasingly integrating their blockchain offerings with established systems, so the trader may be unaware, or indifferent, that they are trading a digital bond. A shift towards permissionless blockchains may alter this.

However, for now, such developments are still exceptional rather than the norm for digital securities.