Kaji Technology Corporation (TSE:6391) – A Deeper Dive into the Numbers

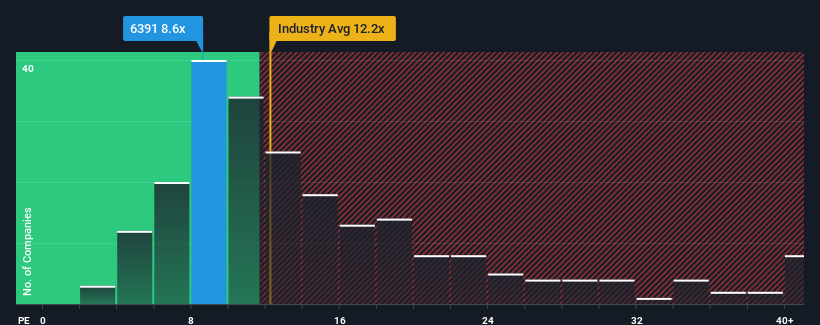

Kaji Technology Corporation (TSE:6391) presents an intriguing case for investors. With a price-to-earnings (P/E) ratio of 8.6x, the stock appears undervalued compared to the broader Japanese market, where about half of companies boast P/E ratios above 14x, and significantly higher multiples are common.

However, a low P/E ratio can sometimes be misleading. It suggests investors are either not that optimistic about the company’s future. Kaji Technology has demonstrated exceptional performance recently, with robust earnings growth. A key question for investors is whether this trend is sustainable.

While there are no analyst estimates available, examining the company’s earnings, revenue, and cash flow can offer valuable insights. The company’s recent performance is striking. Over the past year, Kaji Technology’s bottom line surged by an impressive 139%. Furthermore, earnings per share (EPS) grew by 124% over the last three years. This performance stands in stark contrast to the market’s projected growth of only 12% in the next 12 months.

Given this strong momentum, the low P/E ratio raises questions. It seems that the market may be skeptical about Kaji Technology’s ability to sustain its recent growth trajectory. It’s crucial for investors to understand the reasons behind this market sentiment before making any investment decisions.

The Final Word

It’s important to avoid relying solely on the P/E ratio to make investment decisions. However, the P/E ratio provides a useful indication of the company’s future prospects. The three-year earnings trends for Kaji Technology are better than market expectations, yet the P/E ratio doesn’t fully reflect that.

Investor sentiment shows a clear picture of concerns. Despite strong recent performance and positive trends, investors seem to anticipate potential volatility in future earnings and remain worried about major unobserved threats preventing the P/E ratio from reflecting the positive performance.

Before investing, it is advisable to look for warning signs. You should consider the factors influencing the company’s future performance. Take a closer look at companies that have experienced recent earnings growth and appear to be undervalued.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.