Kyland Technology Co., Ltd. Misses Earnings – Analyst Revises Outlook

Kyland Technology Co., Ltd. (SZSE:300353) recently released its yearly results, which fell short of expectations, prompting an analyst to update their financial models.

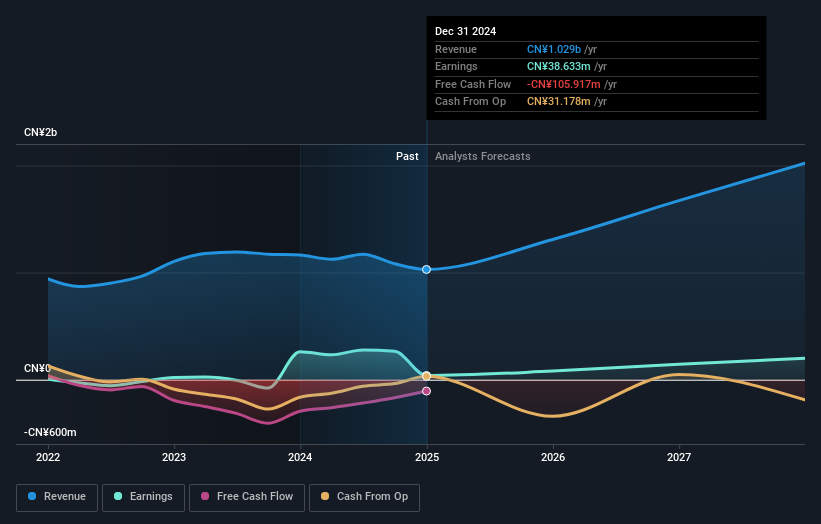

Kyland Technology’s revenue of CN¥1.0 billion was 12% below expectations, and the statutory earnings per share (EPS) of CN¥0.06 missed estimates by 76%.

Following the earnings report, the consensus forecast from the lone analyst is for revenues of CN¥1.31 billion in 2025. This projection reflects a 27% increase in revenue compared to the last 12 months. Statutory earnings per share are predicted to surge 1,030% to CN¥0.71. Before the report, the analyst had anticipated revenues of CN¥1.46 billion and EPS of CN¥0.43 in 2025.

The analyst has adjusted their projections, reducing revenue estimates while significantly increasing the EPS forecast. This suggests an expectation for the business to prioritize profitability over rapid growth.

The average price target increased by 8.0% to CN¥15.84, with the analyst indicating that the improved earnings outlook is a more important determining factor in the company’s valuation.

Comparing Kyland Technology’s projected growth with historical performance and industry trends provides further insight. The analyst anticipates an acceleration in Kyland Technology’s growth, with the forecast 27% annualized growth through the end of 2025. This compares favorably to the company’s historical growth of 12% per annum over the past five years. The industry as a whole is forecast to grow by 19% annually. The analyst appears to expect Kyland Technology to grow at a rate exceeding the wider industry.

Key Takeaways:

- The consensus EPS upgrade points to an improved outlook for Kyland Technology’s earnings potential in the coming year.

- While revenue estimates were lowered, the company is still expected to outperform the industry.

- EPS is considered more significant to value creation for shareholders, and the price target increase reflects the analyst’s positive view of the business’s intrinsic value.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. It is based on historical data and analyst forecasts and does not constitute a recommendation to buy or sell any stock. Simply Wall St has no position in any stocks mentioned.