Lemonade (LMND) is making waves in the insurance industry, and its stock performance reflects the company’s strong growth. Founded in 2015 with the goal of revolutionizing insurance through technology, Lemonade has leveraged artificial intelligence (AI) to streamline processes and improve customer experience. The stock has seen a significant surge, and with the company’s successes in 2024, now might be an opportune moment for investors.

AI at the Core of Lemonade’s Strategy

Lemonade’s success hinges on its AI-driven approach. By automating tasks from providing quotes to handling claims, the company aims to deliver a more efficient and user-friendly experience. According to the company, approximately 97% of all insurance policies are now autonomously sold by AI chatbots. Moreover, the company’s virtual assistant, Maya, offers quotes in under 90 seconds. This rapid turnaround is a significant advantage over traditional insurers, which often involve lengthy processes and waiting times.

Another area where AI shines is in claims processing. AI handles 55% of claims without human intervention. In many cases, customers receive their payments within just three minutes.

Lemonade also utilizes AI in pricing its policies. A series of Lifetime Value (LTV) models predict the likelihood of customers making claims, switching insurers, and purchasing multiple policies. This information helps the company to set competitive premiums and identify underperforming products or markets. The LTV models allow Lemonade to quickly redirect marketing spending for better returns.

Strong Financial Performance

In 2024, Lemonade reported robust financial results. Its in-force premium, which represents the value of premiums from all active policies, increased by 26% year over year, reaching a record $944 million. This growth demonstrates an acceleration from the 20% increase in 2023. The company achieved these results while concurrently reducing its workforce, owing primarily to the automated efficiencies of AI. The company operates in five key insurance markets including renters, homeowners, pet, life, and auto. Having over 2.4 million customers by the end of 2024, which marks a 20% increase from the preceding year.

Significant Progress in Profitability

Lemonade strives to maintain a gross loss ratio of 75% or less, which indicates the proportion of premiums paid out as claims. Although this can fluctuate, the company’s gross loss ratio for the fourth quarter of 2024 achieved a record low of 63%. For the full year 2024, the gross loss ratio was 73%, which is still a sign of steady improvement.

These positive trends have fueled the company’s financial performance. A 98% surge, reaching a record high of $166.9 million in 2024 was observed in the gross profit, combining the rising in-force premium and decreasing gross loss ratio. Even though Lemonade noted a net loss of $202.2 million on a GAAP basis, which encompasses non-cash expenses like stock-based compensation, its preferred metric for profitability is the adjusted free cash flow. This non-GAAP metric reached $47.6 million in 2024, a significant turn from the $113.4 million outflow in 2023, and was the first year in the company’s history with positive adjusted free cash flow.

Why Lemonade Stock Is a Buy Now

Lemonade is still in the scaling phase of its business. While currently operating in the United States, the United Kingdom, and several European countries, the company has plans for expansion. Despite possible short-term setbacks related to expansion, Lemonade’s strong financial underpinnings make it a promising investment for those with a long-term perspective.

Lemonade has expressed a goal of increasing its in-force premium tenfold, to reach $10 billion, over the next nine years. To accomplish this, Lemonade believes that it can expand just as rapidly as the company grew its first $1 billion in in-force premium.

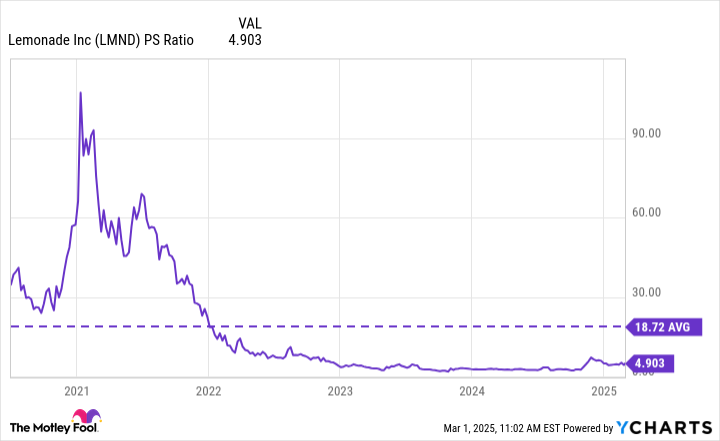

Lastly, a look at valuation shows the company’s stock, with its $526.5 million in revenue in 2024 has a market capitalization of $2.3 billion. As of this writing, that equates to a price-to-sales (P/S) ratio of 4.5.

Given these factors, Lemonade stock has substantial room for growth, and the company’s innovative model provides an opportunity for investors to capitalize on the evolving insurance market.