Innovation is exploding at the biggest tech companies. Meta Platforms is pushing the boundaries of augmented reality, Alphabet is commercializing self-driving cars, and Amazon is automating warehouses with robots. These companies are consistently expanding their technological dominance, laying the groundwork for future growth. However, Microsoft (MSFT) may have recently made the most impressive announcement with its breakthrough quantum computing chip, the Majorana 1. This advancement brings the world closer to the commercialization of quantum computing, thanks to a significant materials science breakthrough by the company, and it could potentially transform the cloud computing market.

Is Microsoft stock a good buy today? Let’s explore the future of cloud computing and weigh the investment potential. Without delving too deeply into technical jargon, here’s a simplified explanation of Microsoft’s Majorana 1 quantum computing chip. Previous methods for building quantum computers made the systems extremely unstable, severely limiting their practical use to closed research environments. Microsoft, however, invented a new material called a topoconductor. The company believes this resolves that stability issue, allowing them to scale up a quantum computer chip to a much larger size while maintaining operational stability. Ultimately, this could bring quantum computing to a broader audience.

This breakthrough from Microsoft, like the invention of the transistor for traditional computers, could trigger a new phase of growth in the quantum computing market. Why is this so exciting? Because of the tremendous potential power of a scaled-up quantum computer. With even a handful of quantum bits (qubits), these computers can solve complex problems that would take years for traditional computers to complete. This could significantly reduce computing costs, especially in the cloud computing market, enabling even more growth for technologies such as artificial intelligence (AI) and autonomous vehicles.

A Technological Wonder Not Ready for Market

One of the biggest hurdles to implementing advanced digital tools worldwide is the high cost of computing. New AI tools require massive spending on data centers to operate, not to mention traditional cloud computing, video streaming, and even modern smartphones. Microsoft alone plans to spend $80 billion on capital expenditures related to AI in 2025, and it’s only one of many companies in this field. The technology sector will likely invest trillions of dollars in data centers over the next several years, particularly when considering China. That’s why quantum computers could become so valuable: they could make computing much more cost-effective. Developers could then make advanced AI tools available to billions, tackle advanced biotechnology and simulation problems that take too long for traditional computers, and achieve even more with these new technologies. It’s certainly exciting.

However, it’s essential to manage expectations regarding the timeline for commercial quantum computers. The Majorana 1 chip is only a prototype and is far from being ready for commercialization. While Microsoft believes it has sped up the timeline for quantum computer adoption, it will still be years—perhaps even decades—before this technology is ready for widespread use. Furthermore, a more immediate factor impacting Microsoft’s business is all the AI capital expenditure and whether it will boost growth for the company.

Should You Invest in Microsoft Stock?

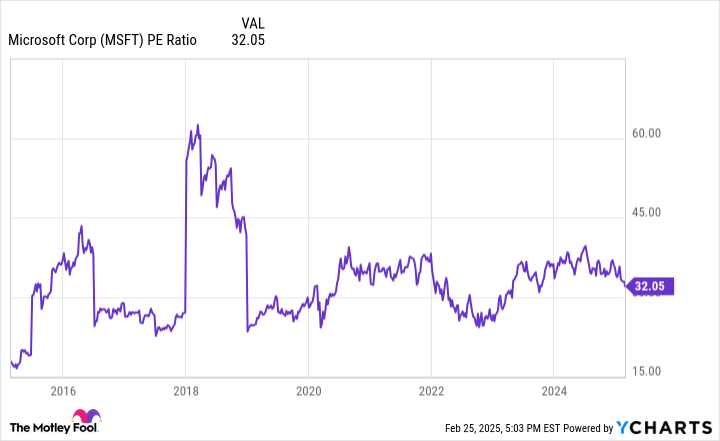

Despite the recent announcement and the hype around AI, as of the time of this writing, Microsoft stock is experiencing a 15% drawdown, one of its worst in the last 10 years. This likely stems from CEO Satya Nadella’s prediction of an oversupply of AI data centers. He made this statement during the same interview in which he introduced the Majorana 1 quantum computing chip. After this decline, Microsoft stock is now trading at a trailing price-to-earnings ratio (P/E) of 32. This is slightly above the S&P 500 average of 30, but it might actually be a “cheap” price for this technology giant.

Microsoft’s revenue is growing at 12% year over year. Operating income has grown even faster, at a 17% year-over-year rate last quarter. This trend seems likely to continue, given the potential for AI revenue for the company’s cloud computing division. If it does, Microsoft’s P/E will decrease quickly over the next few years. Now may be a favorable time to buy if you’re optimistic about Microsoft’s future.