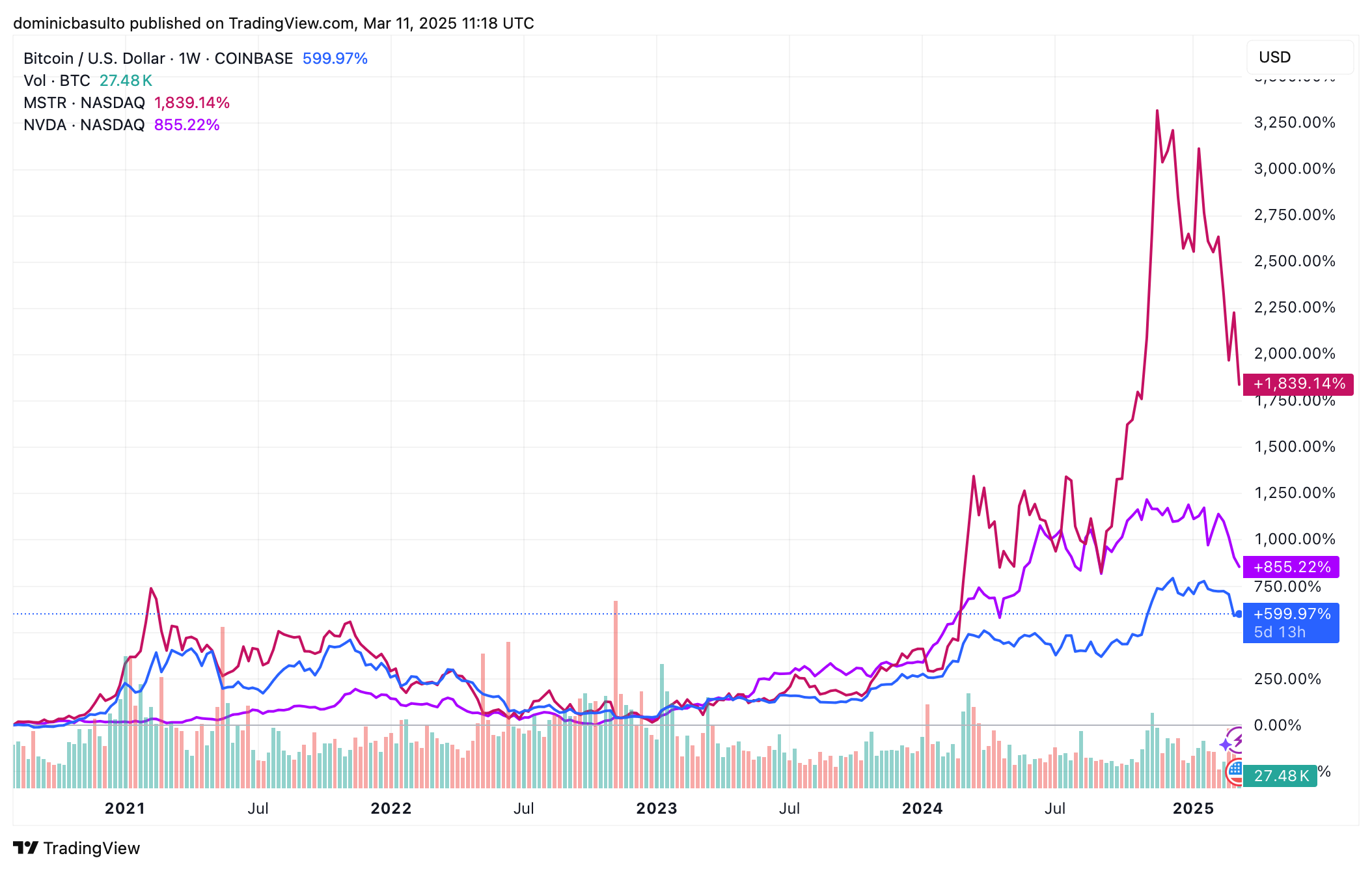

Given Bitcoin’s impressive 600% surge since August 2020, it’s surprising that any tech stock could surpass that growth. However, one company, Strategy (MSTR), formerly known as MicroStrategy, has seen its stock soar over 1,800% during the same period. It’s a performance that has many investors re-evaluating their portfolios.

Strategy’s Stock Market Triumph

Strategy has become a standout performer in the S&P 500 since August 2020. Even tech giant Nvidia (NVDA), with its substantial 855% gain, hasn’t kept pace. This remarkable rise directly coincides with Strategy’s significant investment in Bitcoin. The company has amassed nearly 500,000 Bitcoins, making it the world’s largest corporate Bitcoin holder. This holding represents over 2% of all Bitcoin in circulation and exceeds the U.S. government’s holdings of approximately 200,000 Bitcoins.

The Transformation: From Software to Bitcoin Treasury

Before 2020, Strategy was a software company. Today, it operates as a Bitcoin Treasury Company (BTC), a term coined by Michael Saylor, the company’s founder and executive chairman, to describe a company that is completely focused on acquiring Bitcoin. Strategy’s strategic shift is reflected in its branding. The company’s logo now incorporates the Bitcoin symbol, and the name change emphasizes its singular macro strategy: Bitcoin. In late 2024, the company announced plans to purchase an additional $42 billion worth of Bitcoin over the next three years, financed in part by equity and debt.

The Risks and Rewards

The company’s strategy of using debt to acquire Bitcoin has drawn attention, presenting both opportunities and risks. Critics have raised concerns about the impact of potential Bitcoin price declines, which could significantly affect Strategy’s value. The stock price is highly correlated with the price of Bitcoin, and any fluctuations in the crypto market have a direct effect on the company’s valuation. Concerns about Strategy’s current valuation are also being raised by some analysts and academics. Strategy is currently valued at $60 billion, with Bitcoin holdings estimated at $40 billion. The significant premium reflects investor confidence in the potential for Bitcoin’s continued growth. Given that Strategy’s enterprise software unit is no longer a core focus, its value is largely tied to its digital asset holdings.

However, many analysts remain optimistic about Strategy’s prospects, predicting continued value appreciation. According to Michael Saylor, more government involvement with Bitcoin, such as the creation of a Strategic Bitcoin Reserve, could significantly benefit Strategy. Saylor is now advocating for the U.S. government to acquire 25% of all Bitcoin in circulation by 2035, a move that if enacted, would likely boost Strategy’s value over the next decade.

Should You Invest in Strategy or Bitcoin?

Strategy offers substantial upside potential. However, its performance is heavily influenced by Bitcoin’s volatility. Whether Strategy can outperform Bitcoin over the long term is a matter of debate. Ultimately, the choice between investing in Strategy or Bitcoin depends on an investor’s risk tolerance and investment strategy.