Nanya Technology: A Closer Look at the Stock

Nanya Technology Corporation (TWSE:2408) has recently attracted significant attention due to a notable price increase on the Taiwan Stock Exchange (TWSE). Despite this positive movement, the stock’s current price might be fairly valued, warranting a closer examination to determine its investment potential.

Valuation and Outlook

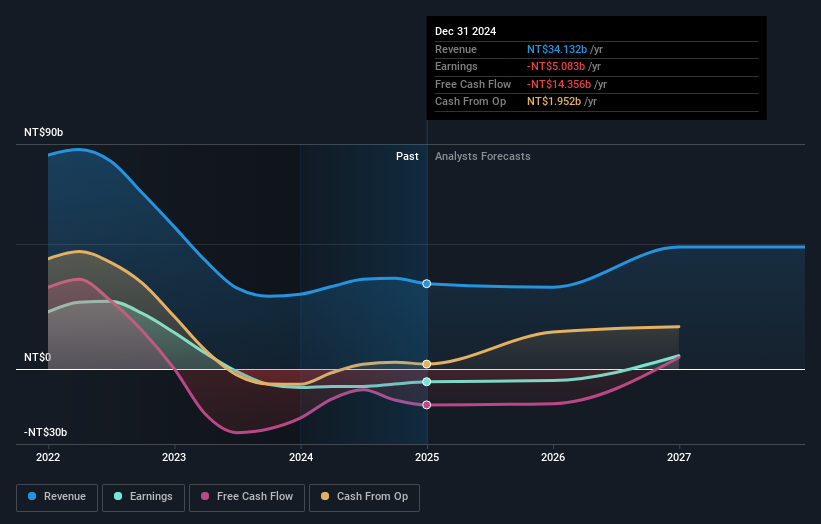

Based on current valuation models, Nanya Technology appears to be trading at a price that’s slightly above its intrinsic value. The stock’s price movements are relatively volatile, and the company’s projected profit growth over the next year is moderate.

Investment Considerations

Given the current market assessment, now might not be the most opportune moment for new investors to buy, especially considering the stock is trading near its fair value. However, investors should consider the positive aspects such as Nanya’s strong balance sheet and the potential for future price drops, which could present more attractive entry points.

Risks and Opportunities

Investors should be aware of the inherent risks associated with Nanya Technology, including potential for short-term price fluctuations, the high beta, and moderate growth expectations. The stock’s overall volatility is a factor.

Conclusion

Further research on Nanya Technology might provide more clarity. Comprehensive analysis of its financial health, market position, and growth prospects will be critical in determining its potential for long-term returns.