Nanya Technology’s Price Jump Raises Questions for Investors

Nanya Technology Corporation (TWSE:2408) shares have seen a significant surge in the last month, climbing 29%. However, this recent gain doesn’t fully offset the losses of the past year, with the stock still down 32% over that period. Given this recent price volatility and the company’s valuation metrics, investors should proceed with caution.

Assessing the High Price-to-Sales Ratio

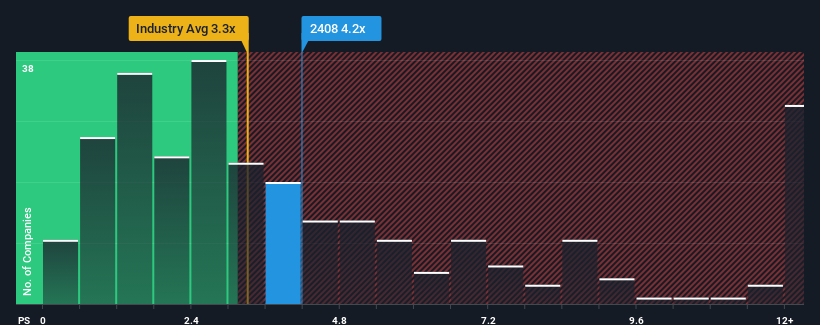

After such a considerable increase, Nanya Technology’s price-to-sales (P/S) ratio of 4.2x warrants careful consideration. Nearly half of the semiconductor companies in Taiwan have P/S ratios below 3.3x, making Nanya’s ratio relatively high. While the P/S ratio is a useful metric, it’s crucial to understand the underlying reasons for its level.

Analyzing Nanya’s Revenue Growth

Nanya Technology has exhibited relatively sluggish revenue growth compared to its industry peers. Investors may be optimistic that this will improve significantly. However, this is uncertain, and investors could be overpaying for the stock if this expectation isn’t met.

Over the past year, Nanya Technology’s revenues increased by 14%. However, revenue has decreased by 60% overall from three years ago. The consensus forecast from analysts is that the company will achieve 13% annual growth over the next three years. This is below the 21% growth forecast for the wider industry.

Investor Sentiment and Future Outlook

This discrepancy between Nanya Technology’s P/S and the broader industry suggests investors are hopeful for a turnaround, although analyst forecasts are not as optimistic. Should the company’s growth fail to gain pace, the current valuation may not be sustainable. Investors may be overestimating Nanya Technology’s potential.

Key Takeaways for Investors

While Nanya Technology shares are trending upwards, the high P/S ratio reflects both current investor sentiment and future expectations. Investors should remember that a weak revenue outlook could increase the risk of a decline in the share price.

This analysis does not constitute financial advice.