Nuvoton Technology Corporation’s Shareholders: Who Holds the Power?

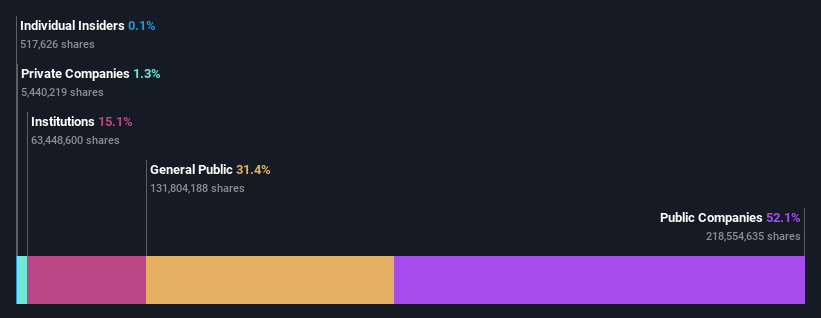

Nuvoton Technology Corporation (TWSE:4919) saw its stock price decline by 5.4% last week, a dip that likely caused disappointment for public companies with significant stakes in the firm. This analysis examines the ownership structure of Nuvoton Technology to understand how different shareholder groups influence the company.

Key Insights:

- Public Companies Dominant: Public companies collectively hold a substantial portion of Nuvoton Technology, giving them considerable influence over management and strategic decisions.

- Major Shareholder: Winbond Electronics Corporation is a single, major shareholder, owning 52% of the company.

- Institutional Investors: Institutions own a notable 15% of Nuvoton Technology.

Ownership Breakdown Deep Dive

With public companies owning the largest share, they are most exposed to the ups and downs of the company’s market capitalization. Last week’s market cap drop of NT$2.1b highlights the impact of market movements on these major stakeholders.

Institutional Ownership

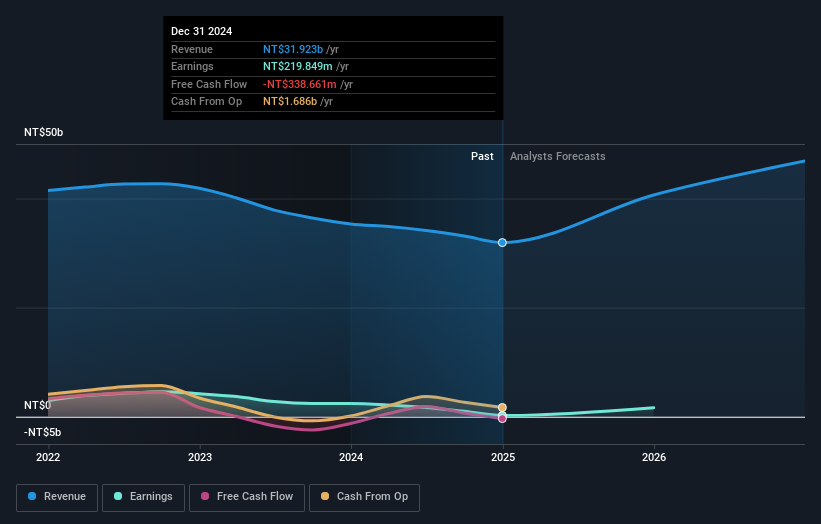

Institutional investors often benchmark their performance against market indices. Therefore, their investment decisions are usually influenced by companies included in major indices. Nuvoton Technology has attracted institutional investors, who collectively hold a significant percentage of the stock. This suggests a degree of credibility among professional investors, though it’s crucial to remember that even institutions make mistakes. Rapid shifts in institutional sentiment can lead to quick share price adjustments, therefore careful consideration of the company’s earnings history is essential.

Major Shareholders

Winbond Electronics Corporation is the largest shareholder of Nuvoton Technology, with 52% of the outstanding shares. This substantial ownership suggests that they have considerable control over the company’s future direction. Behind Winbond, Fubon Life Insurance Co., Ltd., Asset Management Arm holds the second-largest share at 4.6% of the common stock, followed by Fuh Hwa Securities Investment Trust Co., Ltd. with approximately 3.2%.

Analyst Coverage

While examining institutional ownership provides valuable insights, it’s also beneficial to consider analyst ratings. Currently, Nuvoton Technology has some analyst coverage, but increased visibility could be expected over time.

Insider Ownership

Insiders, which typically include board members, own less than 1% of Nuvoton Technology Corporation’s stock. Although this may seem small, even a small proportional interest can align the board’s interests with those of shareholders. In this instance, insiders hold shares worth NT$46m, which shows a modest level of alignment between insiders and other shareholders.

General Public

The general public, including retail investors, own a 31% stake in the company. This group’s holdings are large enough to impact company policies collectively, even if they may not have the power to dictate major decisions.

Public Companies

Public companies together own 52% of Nuvoton Technology. The relationship between these companies can be investigated to see if they may have related business interests, which this ownership may be strategic. Further investigation into this ownership dynamic is advised.

Next Steps

While studying the different shareholder groups is valuable, there are other critical factors to assess when evaluating a company. The report also identifies two potential warning signs for Nuvoton Technology. Furthermore, it’s worth contemplating whether the company will grow or shrink in the future. Analyst forecasts for the company’s future have been compiled in a report for further study.

Note: Figures in this article are based on the last twelve months of data, referring to the period ending on the financial statement’s date. They may not align with the full-year annual report data.

Disclaimer: This article provides commentary based on historical data and analyst forecasts only, and does not constitute financial advice.