Nvidia’s Blackwell AI Chips: Rapid Obsolescence Hurts Cloud Giants

Nvidia’s latest AI chip, Blackwell, is significantly outperforming its predecessor, Hopper. This rapid technological leap is causing concerns for major cloud companies like Amazon, Microsoft, Google, and Meta. The accelerated pace of advancements in this sector is leading to faster depreciation of older GPU assets, which could significantly impact these companies’ operating income.

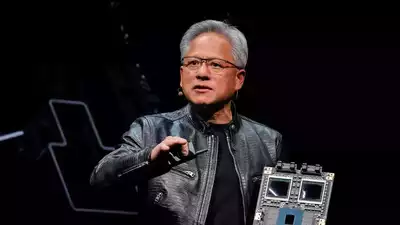

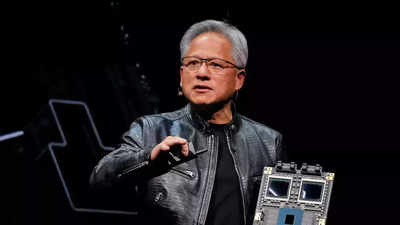

Nvidia CEO Jensen Huang recently quipped about the situation, suggesting that the company’s largest customers might not be thrilled with the implications. The new Blackwell chips are a considerable upgrade over the Hopper models, released in 2022. Cloud companies heavily rely on these GPU systems to power generative AI models.

While more powerful GPUs like Blackwell are generally beneficial for the AI community, the rapid advancements are creating a challenge. Older versions like Hopper quickly lose value, forcing cloud companies to depreciate these assets more quickly. This accelerated depreciation has the potential to significantly affect their financial results.

Huang’s Comments on Hopper Chips

During Nvidia’s AI conference, Huang stated, “I said before that when Blackwell starts shipping in volume, you couldn’t give Hoppers away. There are circumstances where Hopper is fine. Not many.”

Ross Sandler, a tech analyst at Barclays, warned in a statement to Business Insider that cloud companies and Meta would likely need to implement changes, which might result in a substantial reduction in profits.

How Obsolescence May Impact Profits

Amazon Web Services (AWS), the leading cloud provider, already faced these challenges earlier this year. During the company’s earnings call last month, CFO Brian Olsavsky noted, “we observed an increased pace of technology development, particularly in the area of artificial intelligence and machine learning.”

To address this, Amazon is shortening the useful life of some of its servers and networking equipment from six years to five, beginning in January 2025. Olsavsky mentioned this change would decrease operating income by around $700 million this year.

Amazon also “early-retired” some servers and network equipment. This “accelerated depreciation” cost roughly $920 million and is expected to reduce operating income by about $600 million in 2025.

Sandler’s research also showed that the rental costs of H100 GPUs, which use Nvidia’s older Hopper architecture, have dropped as the newer Blackwell GPUs become more available. He noted that this could become a bigger problem for Meta and Google and other high-margin software companies.

Sandler estimates that for Meta, shortening the server lifespan by one year would increase depreciation by over $5 billion in 2026 and reduce operating income similarly. For Google, the comparable adjustment would lower operating profit by $3.5 billion, Sandler added.