Nvidia’s Revenue Soars as Agentic AI Reshapes Businesses

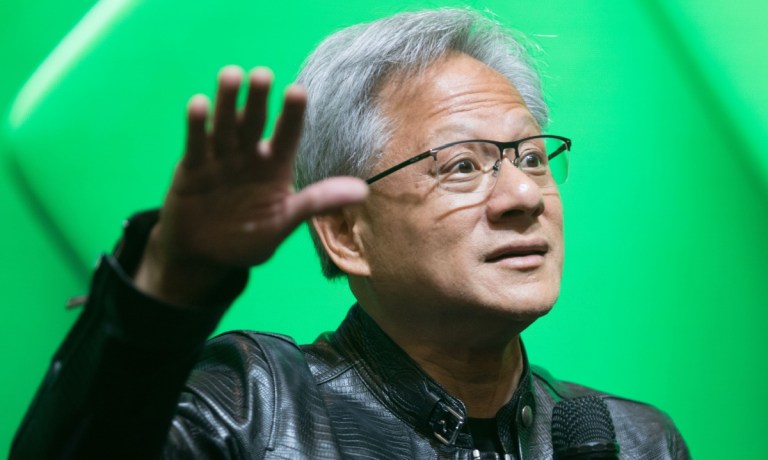

Nvidia’s latest earnings report highlights a surge in revenue, driven by the escalating demand for its cutting-edge chip architectures. Speaking on February 26, 2025, Nvidia CEO Jensen Huang emphasized that the company’s record-breaking financial performance is just the start of a larger trend. “AI is advancing at light speed,” said Huang during a conference call with analysts. “We’re just at the start of the age of AI.”

The company’s Blackwell GPU architecture, despite a two-month delay due to technical issues, achieved $11 billion in revenue in a single quarter. Large cloud computing companies spearheaded sales. Data center revenues more than doubled, propelled by strong demand for Blackwell and its H200 chip series.

Prior to the earnings release, investors expressed concerns that cost-effective AI models, such as those from Chinese AI startup DeepSeek, could potentially weaken demand for Nvidia chips. DeepSeek’s V3 model required only $5.6 million and 2,000 slower H800 Nvidia chips for training. In comparison, OpenAI’s GPT-4 cost $100 million to train using 25,000 H100 Nvidia GPUs. However, Huang countered that DeepSeek’s open-sourcing of their high-performing reasoning model has expanded access to multiple startups and other users. This, in turn, extends the market for AI workloads and, consequently, for GPUs.

According to Brian Colello, Morningstar analyst, “AI GPU demand still exceeds supply, so while slimmer models may enable greater development for the same number of chips, we still think tech firms will continue to buy all the GPUs they can as part of this AI ‘gold rush.’”

From Consumer AI to Business AI

Huang believes the world is just beginning the current wave of AI advancements, which started with generative AI and is now moving towards AI agents that will power business applications. Following these trends, he anticipates the subsequent stage will involve physical AI, such as robots. Huang believes that “AI has gone mainstream” and will become integrated across all industries.

AI is already driving a new wave of software development. In the past, software ran on CPUs, but in the age of AI, software will run on machine learning, Huang noted. He added, “This is the future of software.” Further, data centers will transform into “AI factories” processing AI workloads that will power numerous industries. “We have a fairly good line of sight of the amount of capital investment that data centers are building out towards,” Huang said. “We know that going forward, the vast majority of software is going to be based on machine learning, and so accelerated computing and generative AI and reasoning AI are going to be the type of architecture you’d want in your data center.”

When questioned regarding the impact of U.S. export controls on its advanced chips to China, Nvidia officials stated that sales to China are about half of their pre-restriction levels. However, as a percentage of overall revenue, the impact has remained consistent. The Biden administration banned the sale of certain chips to China in 2022 due to national security concerns. Additionally, the company is keeping an eye on potential tariffs of the chips under the Trump administration. Nvidia stated that the consequences of these tariffs were unknown, depending on the timing, countries affected, and the tariffs’ magnitude.

Nvidia Exceeds Earnings Estimates

The chipmaker’s fiscal year 2025 concluded with a net income of $22.1 billion, equivalent to 89 cents per share, in the fourth quarter. Revenue hit $39.3 billion. These figures surpassed Wall Street analysts’ projections of 85 cents per share and $38.16 billion in revenue. On a year-over-year basis, quarterly net income rose by 80%, and revenue increased by 78%. For the full year, Nvidia reported a net income of $72.9 billion, up 145% from the previous year, on revenue of $130.5 billion, a 114% increase. Earnings per share came to $2.94 for the year, which was just below consensus. However, Nvidia exceeded on the topline; analysts expected $129.28 billion. For the first quarter of fiscal 2026, Nvidia anticipates revenue of $43 billion, with a margin of plus or minus 2%. Analysts expect revenue of $42.05 billion.

Shares of Nvidia remained relatively flat in after-hours trading. The company’s market capitalization reached $3.22 trillion at the close of the market on February 26, placing it second only to Apple in terms of global value.