Nvidia (NVDA) experienced a surge in popularity in early 2023, establishing itself as a leader in the artificial intelligence (AI) boom. The demand for its data center chips, essential for training and operating powerful AI models, fueled rapid market growth that Nvidia has largely controlled. However, the excitement surrounding AI, much like the dot-com era of the late 1990s, has led to market fluctuations. After reaching a high, the Nasdaq Composite has experienced a correction, and Nvidia’s shares have declined significantly. While such events can be concerning, this market adjustment may offer a strategic buying opportunity for long-term investors.

Is Nvidia’s Dip an Opportunity?

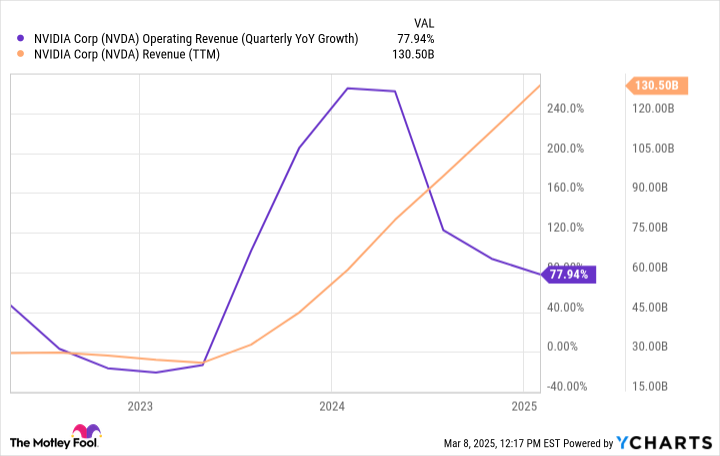

Similar to the late 1990s internet boom, the hype surrounding new technology can often create a bubble. Some of the initial internet stocks saw their values skyrocket before ultimately crashing. While this could happen with some AI stocks, Nvidia is likely not one of them. Nvidia’s stock has increased considerably in the past two years, but actual business growth has driven the stock’s value, not just hype. The company has generated approximately $130 billion in revenue over the last four quarters and continues to grow at nearly 80%:

This growth trajectory is expected to continue. Leading tech companies that are investing in AI data centers, also known as AI hyperscalers, have indicated that they plan to continue their investments throughout 2025, with AI spending potentially exceeding $320 billion this year alone.

Moreover, companies like Alphabet and Microsoft have reported in their most recent earnings calls that cloud demand for AI surpasses supply. OpenAI, the creator of ChatGPT, recently cited a shortage of GPU chips as a reason for delaying product rollouts. These indicators suggest Nvidia’s AI-driven growth is genuine and remains exceptionally strong. With a price-to-earnings (P/E) ratio of 38, and projections for earnings per share to surge over 50% this year and grow by an average of 34% annually over the long term, the company’s market position is strong.

The Broader Picture in the AI Industry

Every stock carries inherent risks. A major risk for Nvidia is that the relatively small number of companies making significant AI investments might decrease their spending or shift their focus. This potential risk may explain why Nvidia’s valuation is considered low compared to its anticipated earnings growth. Investors should be aware of risks. Nvidia’s potential extends beyond the current investment cycle in AI data centers.

The opportunity in generative AI goes beyond models like ChatGPT to various other applications. These include autonomous vehicles, humanoid robotics, and agentic AI that replaces human roles in call centers. As technology advances and costs decrease, AI development is likely to expand to smaller businesses and even individuals.

Nvidia recently announced a Blackwell-powered supercomputer that fits on a desktop. Such innovation means that access to AI technology may extend far beyond today’s AI hyperscalers. Nvidia is well-positioned to capitalize on these advancements by building an ecosystem around its leadership in accelerator chips.

Strategic Investment Considerations

Nvidia continues to deliver strong financial results. The company’s position in AI, arguably this generation’s most significant technological advancement, remains strong. Even if Nvidia achieved an annual earnings growth of 19% over the long term, which is half of what analysts currently estimate, the stock’s current P/E ratio would equate to a price/earnings-to-growth (PEG) ratio of about 2, a reasonable assessment. In short, Nvidia provides a margin of safety if growth is not as strong as anticipated. This is a volatile market prone to change, as recent weeks have demonstrated. Nvidia experienced a nearly 25% decline, a trend likely to continue if market turbulence persists.

While Nvidia currently appears to be a prime AI stock to purchase, investors should proceed cautiously. Consider employing dollar-cost averaging—purchasing shares incrementally over time to capture additional value if prices continue to fall. Remember, almost no one perfectly times the bottom, so dollar-cost averaging can provide more security in volatile markets. Considering the next decade, Nvidia presents a combination of future upside with present-day value.