Oracle’s Cloud: Riding the AI Wave

Oracle, seemingly, didn’t need the xAI deal for its cloud services. While Oracle’s cloud may have been in the running to host a large-scale AI training system for Elon Musk’s xAI startup, with a purported $10 billion in rentals at stake, the company’s latest financial results tell a different story. When the deal with xAI fell through, and Dell and Supermicro were tapped to build the “Colossus” cluster, Oracle’s chairman, Larry Ellison, shrugged it off.

Six months later, Ellison was at the White House alongside OpenAI co-founder and CEO Sam Altman and Masayoshi Son, CEO of SoftBank. SoftBank is providing significant funding for Altman’s Stargate Project, a massive initiative aimed at spending $500 billion over the next four years to advance AI training hardware. While the United Arab Emirates is expected to fund a large majority of the project, Oracle and CoreWeave, among others, are the key initial technology partners. It seems likely that Oracle and CoreWeave, and possibly Microsoft, will be hosting some of the Stargate systems. Despite all this, Oracle appears to be doing quite well in its Oracle Cloud Infrastructure (OCI) business, regardless of the xAI or OpenAI endeavors.

Oracle’s co-founder, chairman, and chief technology officer Larry Ellison makes a presentation.

What matters most is that an AI model’s usefulness relies on the data it is trained with and has access to. For over 400,000 worldwide enterprises that data is stored within Oracle databases or Oracle ERP applications. Oracle is poised to capitalize on this by selling GPU compute services and AI integration into those applications and databases. The Oracle 23ai database already supports native vector data formats and can do RAG with leading-edge techniques. Oracle’s $7.4 billion acquisition of Sun Microsystems in 2010 proved to be prescient, as it gave Oracle a vast base of hardware and software expertise.

After the acquisition of Sun Microsystems, Oracle launched thirteen generations of Exadata database machines, which are essentially database supercomputers. Oracle’s experience with hardware and software co-design, along with its extensive enterprise customer base, positions the company well to build a large cloud business. This mirrors Microsoft’s success, which leveraged its Windows Server user base and SQL Server database to become a major cloud player.

Oracle has another advantage: its database is already deeply entrenched in many organizations. Many of Oracle’s largest customers don’t want AWS, Microsoft, or Google running Oracle databases on their own hardware. They want to run Oracle databases and applications on Oracle-engineered systems within the other major clouds.

Oracle also caters to customers who require a dedicated cloud region. The company offers a flexible approach, where it can manage the infrastructure based on customer needs while billing for services, just as Sun did with their engineered systems. Overall, Oracle is well-positioned to capitalize on the growing demand for cloud services and is particularly well-suited to cater to the unique needs of enterprise customers.

Financial Performance and Future Outlook

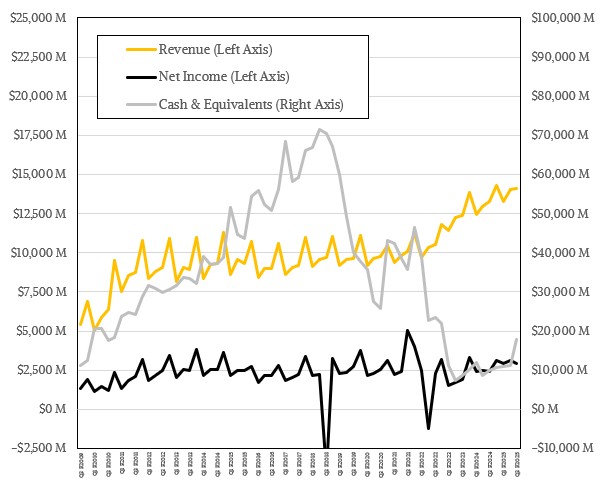

In the quarter ending in February, Oracle reported $14.13 billion in sales, a 6.4% year-over-year increase. Net income surged 22.3% to $2.94 billion, representing 20.8% of revenues. This solid performance comes as Oracle incurs larger infrastructure manufacturing costs, but is still on the low end of the average rate of profitability since the Great Recession.

Oracle’s cash reserves have continued to grow, which has led to aggressive stock buybacks. Its capital expenditures are fairly modest for the industry, with approximately $6.87 billion spent in fiscal 2024 and expected to reach around $16 billion in fiscal 2025. During a call with Wall Street analysts, CEO Safra Catz indicated that Oracle projects roughly $57.4 billion in revenues this year. The company anticipates around 15% growth in fiscal 2026 to approximately $66 billion and has raised its guidance for fiscal 2027 to 20% growth, which would equate to nearly $80 billion. Depending on the success of OpenAI and SoftBank’s Stargate Project and how much hosting Oracle secures for its systems, Oracle could become the fifth company in IT history to surpass $100 billion in sales.

Oracle has $130 billion in remaining purchase obligations, or RPOs, which is up significantly from the same time period in the previous year. As Ellison mentioned, Oracle’s vision is that its applications will eventually be collections of agents, which can be added to legacy transaction processing applications.

Oracle’s hardware business is trending downward as customers shift to OCI, but hardware sales still totaled nearly $3 billion in the trailing twelve months. In Q3 F2025, Oracle sold $703 million in hardware, with operating income of $506 million, or 72% of revenue. Those robust margins are similar to those of Oracle’s cloud services offerings.

Oracle’s Cloud: IaaS Growth Outpacing SaaS

Oracle presents its quarterly results in two manners: by product divisions and by product groups, the latter being split between Applications Cloud Services and License Support and Infrastructure Cloud Services and License Support. Oracle’s infrastructure software business is now growing faster than its various applications software businesses on its cloud or its software sold to run on other clouds.

In Q3 F2025, the application software part of the cloud business brought in $4.81 billion, a 5% increase; but the infrastructure cloud business grew by 15.2% to just under $6.2 billion. The sequential growth rate of the infrastructure business is now five times faster than the applications business.

Oracle’s IaaS has been growing steadily as the company builds out its OCI cloud and IaaS has grown from under 20 percent to more than 40 percent of revenues from August 2020 to today. Oracle is interesting in that it is a SaaS vendor building an IaaS cloud, whereas Amazon Web Services was an IaaS that had to build a SaaS stack and partner with others to build that up to more than half of the business.

During a call with Wall Street, Larry Ellison disclosed that Oracle is building a cluster based on Nvidia GB200 compute engines, with a total of 64,000 GPUs. In addition, Oracle signed a multi-billion dollar contract with AMD in Q3 to build a cluster with 30,000 Instinct MI355X GPU accelerators. The MI355X is designed to compete with Nvidia’s “Blackwell Ultra” B300 accelerators.