OYO Eyes INR 1,100 Cr in FY26 PAT

OYO, the hospitality giant, is projecting a significant profit of INR 1,100 Cr in FY26, following a reported profit of INR 229 Cr in FY24. This optimism is largely fueled by their recent acquisition of US-based G6 Hospitality, the parent company of Motel 6 and Studio 6. According to founder and CEO Ritesh Agarwal, G6 Hospitality’s integration is expected to substantially improve OYO’s financial performance. G6 alone is projected to contribute an EBITDA of INR 630 Cr in the upcoming fiscal year, pushing OYO’s combined EBITDA to over INR 2,000 Cr. This aligns with internal company sources from last year, when OYO anticipated a quick return on investment from the G6 acquisition.

This optimistic outlook comes at a time when the company faces pressure from lenders to expedite its IPO or address outstanding debt repayments. Creditors have reportedly set a deadline of October this year for OYO to list publicly, or face a demand for $383 Mn in loan repayments. Despite these pressures, OYO continues to generate profits. The company forecasts profits of INR 700 Cr in the current fiscal year, with a nearly sixfold increase in net profit to INR 166 Cr in Q3 FY25, alongside a 31% year-over-year revenue increase to INR 1,695 Cr.

From The Editor’s Desk

Darwinbox Bags $140 Mn

The HR tech startup, which achieved unicorn status in 2022, has secured $140 million in a funding round co-led by Partners Group and KKR. Darwinbox offers comprehensive solutions for recruitment, onboarding, payroll, and people analytics.

NoPaperForms Lines Up Bankers For IPO

The Info Edge-backed enterprise tech startup has appointed IIFL Capital and SBI Capital as bankers for its initial public offering. The company plans to file its DRHP (Draft Red Herring Prospectus) within the next couple of quarters, aiming for an IPO at a valuation of INR 2,000 Cr.

Peak XV’s Shraeyansh Thakur Quits

Shraeyansh Thakur, an investor at Peak XV Partners, has announced his departure to pursue entrepreneurial ventures. This marks the fifth significant exit at Peak XV Partners in the past 12 months.

Ola Electric Gets Sops

Ola Electric, the electric vehicle manufacturer, has become the first two-wheeler EV maker to receive incentives under the Centre’s scheme for automotive and auto components. The company has been granted subsidies worth INR 73.7 Cr based on its FY24 sales.

Zetwerk Nets $5 Mn

Zetwerk, the manufacturing unicorn in preparation for an IPO, has raised $5 million in a funding round led by Arc Investments and Oriental Biotech. The company’s board passed a special resolution in February to raise this capital via the issuance of 9.93 Lakh CCPS at INR 432.718 apiece.

Tesla All Set For India Entry

The EV maker has signed a lease agreement to open its first showroom in India in Mumbai’s Bandra Kurla Complex. The deal establishes a new national benchmark, with Tesla set to pay INR 3.87 Cr for the first year for a 4,003 sq ft space.

Saina Nehwal Backs Naarica

Naarica, a femtech brand, has onboarded badminton star Saina Nehwal as an investor and brand ambassador. The startup sells reusable period underwear and claims to utilize toxin-free and anti-microbial technology to help prevent urinary tract infections.

India Preps For Satcom Launch

India is preparing for a potential launch of satellite internet services by June, as TRAI (Telecom Regulatory Authority of India) nears completion of the spectrum allotment pricing. This will enable satcom operators to provide high-speed internet in remote and maritime areas.

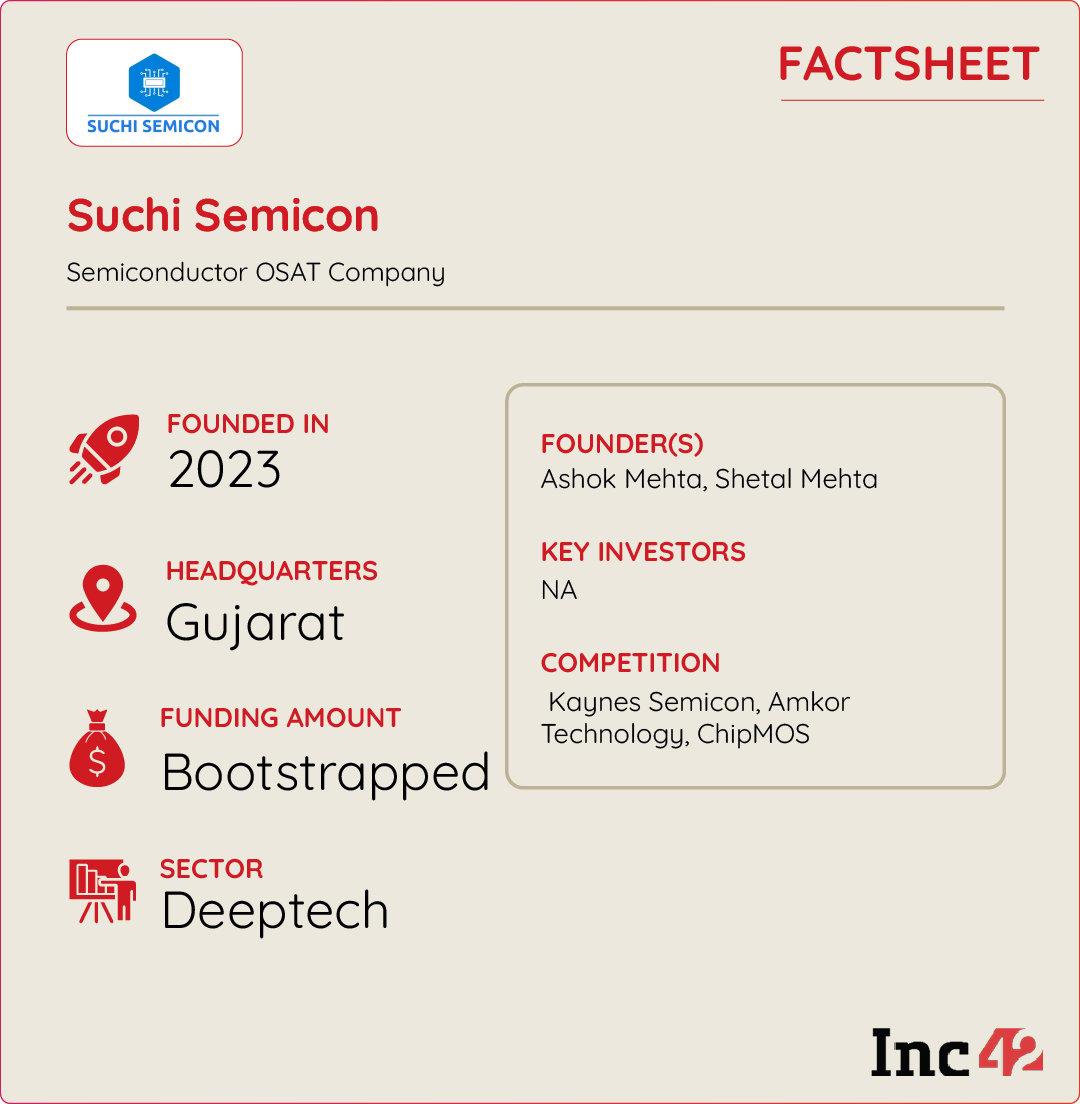

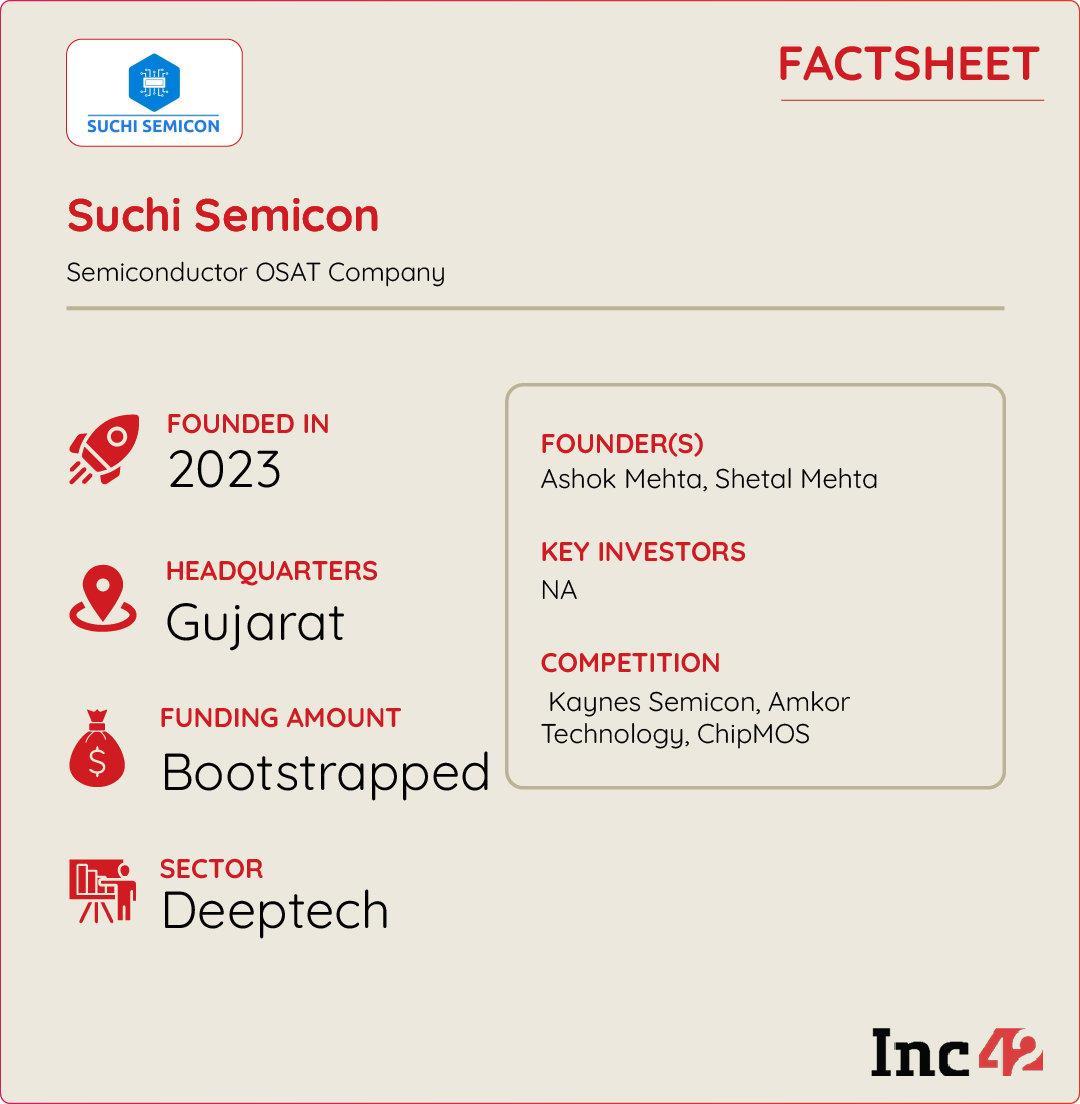

Inc42 Startup Spotlight: Can Suchi Semicon Power India’s Semiconductor Dreams?

Ashok Mehta, coming from a textile background, transformed Suchi Industries into a major embroidery manufacturing company by 2022. However, a chance encounter with vendors in Malaysia, an outsourced semiconductor assembly and test (OSAT) hub, shifted Mehta’s focus and business aspirations.

Teaming with his son Shetal Mehta, he entered the semiconductor sector and founded Suchi Semicon in 2023. Suchi Semicon operates as an OSAT, offering services such as assembly, packaging, and testing of integrated circuits. The company started constructing its factory in Surat in 2023, with an investment of INR 840 Cr. The facility, which commenced operations in December last year, is expected to begin commercial production by March of this year, following the delivery of equipment. With a production capacity of 1.5 Lakh chips daily, Suchi Semicon aims to increase production to 3 Mn chips a day in the next three years. Additionally, the startup plans to expand its workforce to 1,000 employees during this period and open another factory in collaboration with a Japanese company.