PAR Technology Corporation’s Impressive Stock Performance

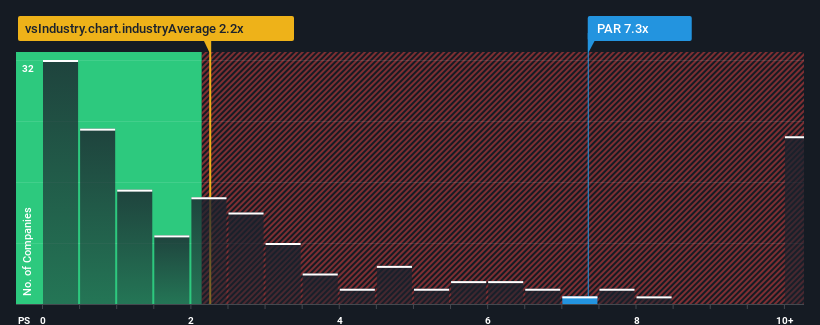

PAR Technology Corporation (NYSE:PAR) has experienced a significant surge in its stock price, gaining 26% in the last month and 57% over the past year. This impressive performance has led to a high price-to-sales (P/S) ratio of 7.3x, which is considerably higher than the industry average. In this analysis, we’ll delve into the factors contributing to this elevated P/S ratio and whether it’s justified.

Revenue Growth Driving the P/S Ratio

The company’s recent revenue growth has been impressive, with a 38% increase last year and a 24% overall rise over the past three years. According to analyst forecasts, revenue is expected to climb by 22% in the coming year, outpacing the industry’s 12% growth forecast. This strong revenue outlook is likely driving the high P/S ratio, as shareholders are confident in the company’s future prospects.

The Bottom Line

PAR Technology’s high P/S ratio is justified by its strong revenue growth and positive analyst forecasts. However, investors should be aware of potential risks, including two warning signs identified in the analysis. Overall, the company’s solid financial performance and growth prospects make it an attractive investment opportunity in the electronic equipment industry.

Additional Insights

For investors looking for more information, our free report on PAR Technology provides a comprehensive analysis of the company’s prospects. Additionally, our portfolio management tool allows you to track your investments and receive alerts on potential risks.