PAR Technology Corporation’s Prospects Appear Bright, Warranting High Valuation

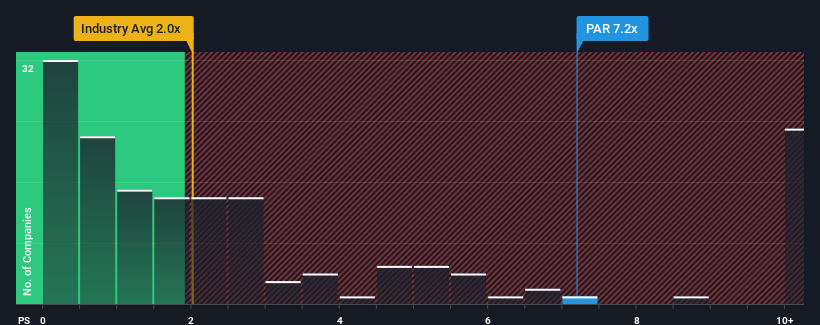

When compared to most companies in the Electronic industry in the United States, PAR Technology Corporation (NYSE:PAR) presents a unique case. With a price-to-sales (P/S) ratio of 7.2x, PAR’s valuation is significantly higher than the industry average. Many companies in the Electronic industry have P/S ratios below 2x. This disparity warrants a closer look to determine if the higher valuation is justified.

What Does PAR Technology’s P/S Mean for Shareholders?

PAR Technology has demonstrated strong revenue growth compared to its peers recently. This positive performance seems to be what the market is anticipating will continue in the future. This expectation is what is driving the elevated P/S ratio. However, if the company fails to meet these expectations, investors risk overpaying for the stock.

To gain a deeper understanding of the company’s potential, a look at analyst forecasts is beneficial. According to these estimates, PAR Technology’s revenue is projected to grow at a rate of 20% per year over the next three years. The rest of the industry, by comparison, is only forecast to expand by 8.9% annually. This significant difference in anticipated growth helps explain why PAR Technology commands a higher P/S ratio.

The company has been successful in growing its revenue over the past few years. The company reported an impressive 26% revenue increase in the last year and a 24% overall rise in revenue over the past three years, largely due to its short-term performance.

The Final Word

While the P/S ratio shouldn’t be the sole determinant in investment decisions, it serves as a useful gauge of revenue expectations. In PAR Technology’s case, the high P/S ratio appears to be supported by expectations of strong future revenue growth. Investors seem confident in the company’s ability to continue increasing its revenue, which has supported the current valuation. Under these circumstances, a significant drop in the share price in the near future seems unlikely.

Before making any investment decisions, it’s important to be aware of potential risks. You should be aware of the warning signs for PAR Technology.