{ “title”: “PAR Technology: Is the Recent Stock Surge Justified?”, “description”: “An examination of PAR Technology’s recent stock performance and valuation metrics in the context of industry trends, including market data and analyst forecasts.”, “tags”: “PAR Technology, stock analysis, NYSE:PAR, price-to-sales ratio, investment analysis”, “rewritten_content”: “## PAR Technology Corporation: A Closer Look at Recent Stock Performance

PAR Technology Corporation (NYSE:PAR) has seen a significant surge in its stock price recently, prompting investors to take notice. The company’s shares have jumped 26% in the last month alone and are up 104% over the past year.

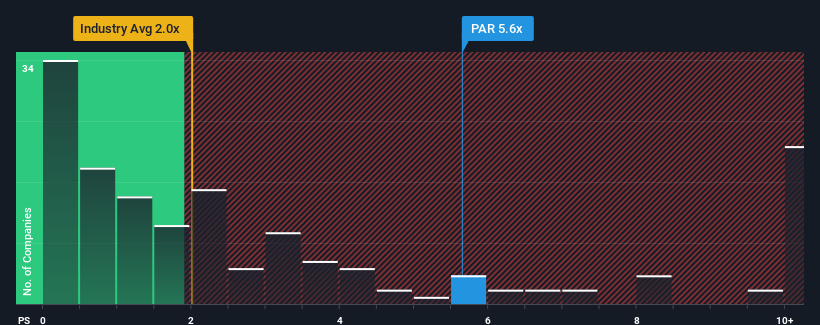

This rapid increase in value raises questions about the company’s valuation, especially when compared to its industry peers. As of November 7, 2024, with a price-to-sales (P/S) ratio of 5.6x, PAR Technology appears expensive compared to the broader electronic equipment and components sector in the United States, where nearly half of the companies have P/S ratios below 2.1x. However, a high P/S ratio doesn’t automatically mean a stock is overvalued; there may be underlying factors at play.

Recent Performance and Revenue Growth

PAR Technology’s recent performance has been relatively strong, with impressive revenue growth compared to many of its competitors. This strong performance has likely driven up investor expectations, which may have contributed to the high P/S ratio.

Examining the recent revenue figures, PAR Technology experienced a robust 30% revenue increase last year. Furthermore, the company’s revenue has increased by 80% over the past three years. These figures indicate an impressive growth trajectory for the company. The current P/S ratio is therefore typical of a company that is expected to considerably outperform the industry.

Future Outlook and Analyst Estimates

Looking ahead, analysts predict a decrease in revenue for the coming year. According to estimates from nine analysts, revenue is expected to decline by 7.2%. This forecast is not particularly encouraging, especially when contrasted with the rest of the industry, which is projected to grow by 9.1% in comparison. Nevertheless, some investors appear optimistic, which can be read in the high P/S ratio.

Implications for Investors

While a high price-to-sales ratio shouldn’t be the only factor influencing investment decisions, it can provide insight into revenue expectations. In PAR Technology’s case, the company currently trades at a higher-than-expected P/S ratio, despite the forecast of declining revenues. This situation might suggest that the share price is at risk of a correction if the P/S ratio falls to levels more aligned with the negative growth outlook.

Investors should exercise caution at these price levels, especially if the company’s performance does not improve. Be aware that PAR Technology shows warning signs in investment analysis.

Disclaimer: This article is based on historical data and analyst forecasts and is not financial advice.

Simply Wall St has no position in any of the stocks mentioned in this article.

About PAR Technology

PAR Technology provides cloud-based hardware and software solutions for the restaurant and retail industries globally.

“}