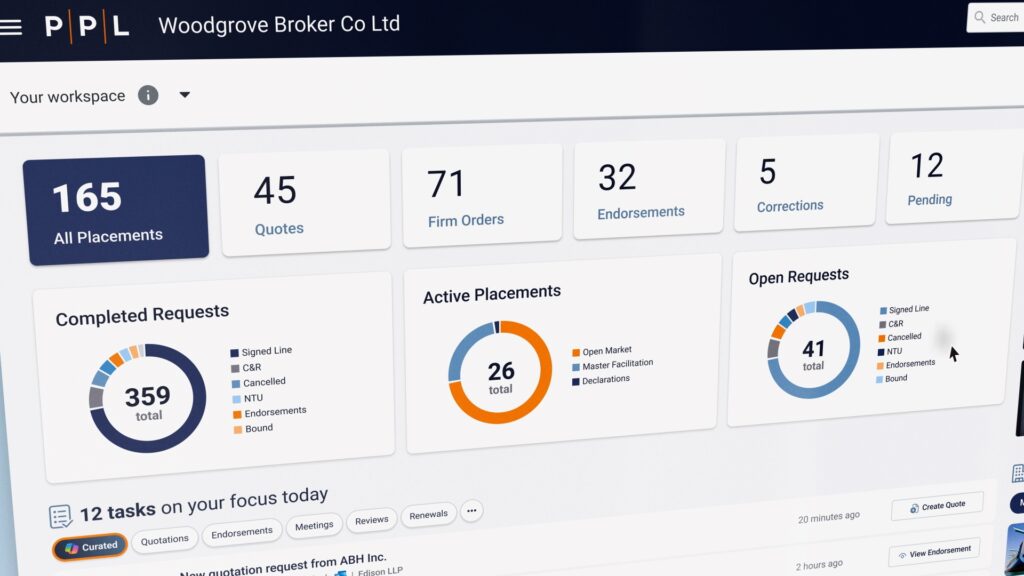

AIFinancial ServicesInsurance Placing Platform Limited (PPL) has announced a multi-year agreement to integrate Microsoft’s data, AI, and productivity tools into its specialty insurance trading platform. This move aims to streamline the document-led, administrative processes, transitioning to a more intuitive trading platform and a central data hub.

This collaboration will leverage Microsoft Teams, Microsoft 365 Copilot, and Microsoft Power BI to create a suite of PPL productivity tools. By accelerating data-driven trading, brokers and carriers will be able to respond more quickly, saving time for those important, high-value relationships.

The key benefits of the partnership are:

- Enhanced market collaboration through a PPL directory, managed on Microsoft Teams for quicker contact and response times. This simplifies the capture of trading activity that currently occurs outside the platform.

- Actionable broker and carrier insights from bespoke PPL Copilot prompts, allowing real-time comparison, analysis, and informed decision-making.

- An intelligent, Microsoft Fabric-powered data hub will store end-to-end trading data, providing clients with easily accessible, secure, and rich data to inform business decisions.

PPL CEO John Mason emphasized the value of the partnership, stating, “I am hugely excited about the opportunities that this relationship brings for the London market. In collaboration with Microsoft, PPL has the ability to create a step-change in how our clients interact with each other across the end-to-end trading cycle.”

Mason added, “This is a transformational deal and one that relies not on costly untested development processes, but the use of existing well-tested tools that almost everyone already knows how to use.”

Bill Borden, Corporate Vice President, Worldwide Financial Services at Microsoft, also highlighted the partnership’s potential. He stated, “This latest initiative between PPL and Microsoft is rooted in our shared vision of empowering the insurance industry with innovative tools that boost efficiency and unlock new avenues for growth. Through a simplified collaboration platform and dynamic, data-driven trading environment, we aim to streamline processes and provide real-time insights that enhance decision-making across the market.”

John Neal, CEO of Lloyd’s, observed that transitioning to a data-first digital trading environment “will help drive London Market growth and innovation.” He believes this partnership “has the potential to accelerate and capture this opportunity.”