Qingdao Hi-Tech Moulds & Plastics’ Price Climb: Is It Justified?

Shareholders of Qingdao Hi-Tech Moulds & Plastics Technology Co., Ltd. (SZSE:301022) have reason to celebrate. The company’s stock price jumped 39% in the last month, rebounding from previous weakness. Additionally, the stock has increased by 32% over the past year, a positive trend that is encouraging to see.

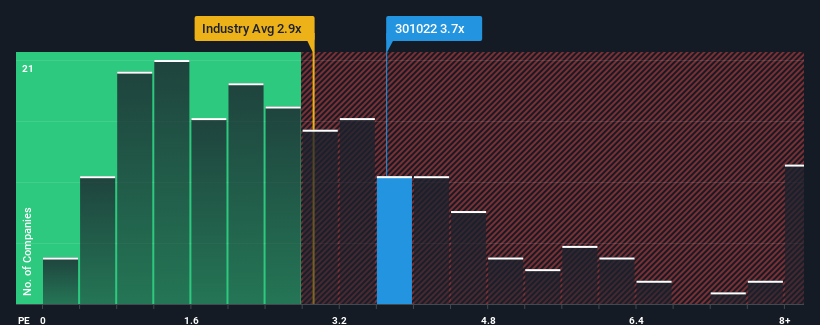

However, this recent price surge brings its own set of questions. With a price-to-sales ratio (P/S) of 3.7x, one might wonder if this growth is sustainable, especially when considering that nearly half of the companies within China’s Auto Components industry have P/S ratios under 2.9x. A deeper dive is necessary to determine if the stock’s elevated P/S ratio is supported by rational factors.

Recent Performance

Qingdao Hi-Tech Moulds & Plastics has shown expanding revenue, which is a good sign. The market might be betting on this solid revenue performance outshining the industry in the near future, which, in turn, could lead to a sustained P/S. If not, current shareholders may be concerned about the share price.

Revenue Growth Trend

The assumption is that a company should outperform the industry for P/S multiples such as Qingdao Hi-Tech Moulds & Plastics’ to be valid. The company’s revenue increased markedly by 20% over the last year. Over the past three years, revenues have also increased by 14%, primarily due to the recent 12 months of growth. Therefore, we can confidently say that the company has performed well in growing its revenue during that time.

However, the industry’s one-year growth prediction of 24% makes the medium revenue trends less appealing. It is concerning that the P/S of Qingdao Hi-Tech Moulds & Plastics is higher than that of the industry. Most investors appear to be discounting recent, relatively modest growth rates while hoping for a turnaround in the company’s prospects. A continuation of recent revenue trends will weigh heavily on the share price eventually.

P/S Insights

As its shares have increased, so has the P/S of Qingdao Hi-Tech Moulds & Plastics. It is generally best to use the price-to-sales ratio to assess the market’s overall view of a company’s financial health. We found that the company’s poor three-year revenue patterns did not detract from the P/S as much as we had anticipated, especially when they are viewed in the context of industry expectations. If revenue growth falls behind that of the industry while the P/S increases, the share price runs a considerable risk of declining, driving the P/S down. Unless the recent medium-term conditions improve significantly, it will be difficult to consider these share prices fair.

Before making up your mind, there are 3 warning signs for Qingdao Hi-Tech Moulds & Plastics that you should be aware of. These factors may cause you to re-evaluate your opinion on Qingdao Hi-Tech Moulds & Plastics. Consider exploring our interactive list of high-quality stocks to get an idea of other investment possibilities.

This analysis is based on historical data and analyst forecasts and is not financial advice.