Qingdao Hi-Tech Moulds & Plastics Technology: Is the Stock Overvalued?

Qingdao Hi-Tech Moulds & Plastics Technology Co., Ltd. (SZSE:301022) has experienced a significant 39% price increase in the past month, culminating in a 32% gain for the year. This rapid increase raises questions about the company’s valuation, particularly when considering its price-to-sales (P/S) ratio.

Valuation Concerns

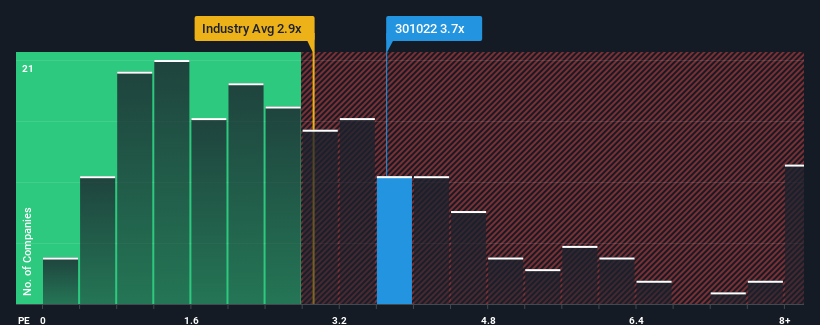

The current P/S ratio for Qingdao Hi-Tech Moulds & Plastics Technology stands at 3.7x. This figure appears high when compared to the average P/S ratio of China’s auto components industry, where nearly half of the companies have P/S ratios below 2.9x.

The company has shown recent revenue growth. Investors might be optimistic, anticipating that the company will outperform its competitors in the coming period, which could explain the elevated valuation. However, the analysis indicates that the P/S ratio may not be justified.

Revenue Growth Analysis

Over the last year the company experienced a 20% increase in revenue. The past three years have seen a cumulative rise of 14% in revenue.

The auto components industry is expected to grow by 24% over the next year. The company’s P/S ratio is high compared to these figures. It’s possible that the company’s existing shareholders are overly optimistic about expectations for the company’s performance.

Risks

Given the slower revenue growth relative to the price increase, there’s a risk that the share price could decline, thus lowering the P/S ratio. Unless there is a significant improvement in upcoming performance, it seems difficult to prevent the P/S ratio from falling to a more reasonable level.

This article is for informational purposes only and should not be considered financial advice.