Retail Investors Shoulder Losses as AVIC Aviation High-Technology Market Cap Declines

Retail investors in Avic Aviation High-Technology Co., Ltd. (SHSE:600862) bore the brunt of a recent market downturn, as the company’s market capitalization decreased by CN¥1.8 billion last week.

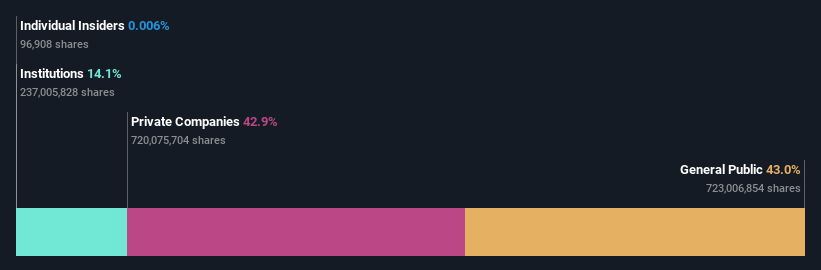

Ownership Structure and Investor Impact

Analysis of the company’s shareholder structure shows that retail investors are the dominant group, holding approximately 43% of the total shares. This significant ownership stake means that retail investors are heavily influenced by the company’s financial performance.

During the recent decline, this group experienced the most significant losses, with the stock price falling by 4.4%.

Institutional and Insider Ownership

Institutional investors hold a considerable portion of the company’s stock, approximately 14%, which may indicate credibility among professional investors. However, the analysis notes that relying on institutional ownership alone is not sufficient, as institutions, like any investor, can make poor investment choices.

Insider ownership is less than 1%, which can signal a lack of alignment between the board and other shareholders, potentially impacting long-term performance.

The largest shareholder is Aviation Industry Corporation of China, Ltd., holding 37% of outstanding shares.

Key Shareholders

Further investigation reveals that the top eight shareholders collectively account for roughly 50% of the register. This suggests a balance among larger and smaller shareholders.

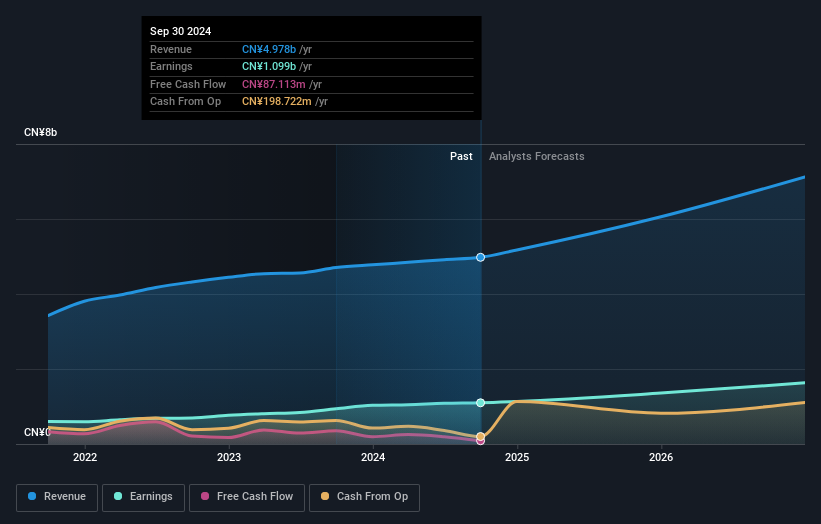

Analyst Forecasts

The report also stresses the importance of considering analyst sentiments. There are numerous analysts covering the stock, and their forecasts could offer valuable insights into the future.

Looking Ahead

The article concludes by emphasizing the importance of understanding the different shareholder groups. It encourages readers to consider various factors, including an investment analysis of the stock, and consult analyst forecasts for future growth projections.

Disclaimer: This article provides commentary based on historical data and analyst forecasts; it is not financial advice.