Robosense Technology (HKG:2498) Posts Impressive Gains, But Is the Stock Overvalued?

Shares of Robosense Technology Co., Ltd (HKG:2498) have surged recently, climbing 57% in the last month and 39% over the past year. This rapid growth prompts an examination of the company’s valuation, particularly its price-to-sales (P/S) ratio.

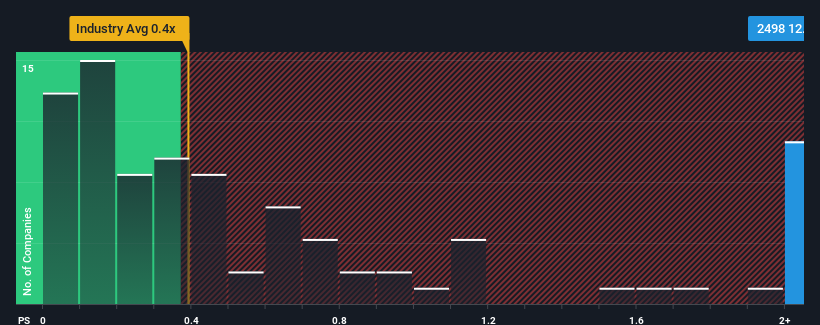

With a P/S ratio of 12.2x, Robosense Technology appears expensive when compared to the electronic equipment and components industry in Hong Kong, where approximately half the companies have P/S ratios below 0.4x. However, a high P/S ratio doesn’t automatically disqualify a stock. It’s crucial to understand the underlying reasons for this premium.

Understanding Robosense Technology’s P/S Ratio

The company’s recent revenue performance provides a key piece of the puzzle. Robosense Technology has demonstrated robust revenue growth, exceeding many of its industry peers. This strong top-line performance likely fuels investor expectations for continued success, justifying the higher P/S multiple.

To gain deeper insights into future revenue projections, investors can access a complimentary report on Robosense Technology. This report provides valuable data to inform investment decisions.

Examining Revenue Growth Trends

A high P/S ratio is often justifiable if a company significantly outperforms its industry in terms of revenue growth. In Robosense Technology’s case, the company’s revenue increased by an exceptional 125% over the past year. This impressive performance also translates into substantial revenue growth over the last three years.

Looking ahead, the nine analysts covering Robosense Technology estimate an average revenue growth of 34% per year over the next three years. This forecast is substantially higher than the 25% annual growth predicted for the broader industry. This optimistic outlook supports the company’s elevated P/S ratio, as investors are willing to pay a premium for future growth potential.

Conclusion

Robosense Technology’s P/S ratio has benefited from its recent share price increase. While the P/S ratio isn’t the sole indicator of value, it is a useful measure of market sentiment. Based on analyst forecasts, strong revenue prospects contribute to its higher valuation. Current market sentiment suggests investors are optimistic, with the potential for a significant decline in revenues appearing remote. Therefore, the current high P/S ratio appears justified, and a sharp fall in share price is unlikely in the short term.

Investors should, however, be aware of the potential risks. Robosense Technology has two warning signs that investors should review before making any investment decisions. If you’re seeking companies with demonstrated earnings growth, you may want to review this free collection of companies with robust earnings and low P/E ratios.