RoboTechnik Intelligent Technology: Retail Investors’ Influence

Recent analysis of RoboTechnik Intelligent Technology Co., LTD (SZSE:300757) reveals important insights into its shareholder structure. Retail investors, who collectively hold a significant portion of the company’s shares, experienced losses following a 3.1% price drop last week. This ownership distribution suggests that individual investors have a considerable say in the company’s management decisions and overall business strategy.

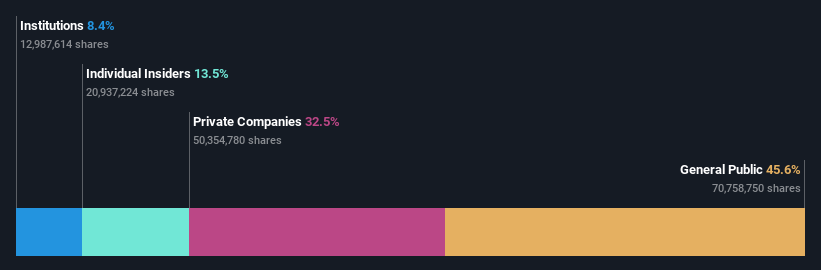

Ownership Breakdown

The largest shareholder group, with approximately 46% ownership, is retail investors. This means that they stand to benefit the most from stock price increases but also bear the brunt of downturns. Notably, the top 10 shareholders control about 51% of the company. Insiders hold a significant 14% stake, indicating a vested interest in the company’s performance.

The largest single shareholder is Suzhou Yuanjiesheng Enterprise Management Consulting Co., Ltd., with 26% of the outstanding shares. Shanghai Kejun Investment Management Center (Limited Partnership) and Jun Dai hold the second and third largest positions, with 6.9% and 4.3% respectively. Jun Dai also serves as the Chairman of the Board.

Institutional and Insider Ownership

Institutional investors are also present on the shareholder registry, holding a respectable stake, which often suggests credibility among professional investors. However, the absence of analyst coverage indicates the company is not widely followed currently.

Insider ownership is an important factor to consider. High insider ownership can signal that leadership aligns with the interests of other shareholders. Insiders own a noteworthy CN¥3.8b worth of shares in the CN¥28b company.

Public and Private Company Stakes

The general public, primarily individual investors, holds 46% of the company’s shares, giving them considerable influence over the company’s operations. Additionally, private companies own 32% of RoboTechnik stock, which is an area for further investigation.

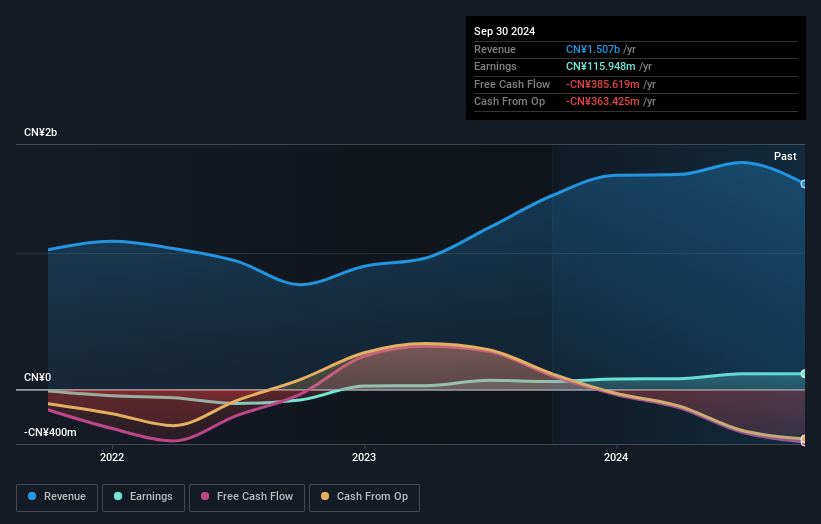

Disclaimer: This analysis is based on data from the last twelve months.