Investing in the AI Revolution: A Long-Term Perspective

The recent market sell-off, particularly affecting tech stocks, might seem daunting. However, it’s crucial to maintain a long-term focus, especially when considering the burgeoning field of artificial intelligence. We are still in the early stages of the AI investment wave, barely scratching the surface of its integration into our businesses and daily lives. The next five years promise accelerated development, creating significant opportunities for savvy investors.

In the current market climate, I believe it’s time to identify promising AI stocks that now appear undervalued. The market presents numerous opportunities to acquire stakes in leading AI companies at potentially advantageous prices. After analyzing the landscape, I’ve narrowed my focus to four key suppliers driving the AI revolution: Taiwan Semiconductor (TSM), ASML (ASML), Nvidia (NVDA), and Broadcom (AVGO). These companies form the backbone of the AI industry, and without them, the AI landscape would be unrecognizable.

Taiwan Semiconductor: The Foundation of AI

I’ll begin with Taiwan Semiconductor (TSMC), as it is, in many ways, the epicenter of this technological advancement. As the world’s leading chip foundry, TSMC fabricates chips designed by companies like Broadcom and Nvidia. Its leading technology and a strong history of innovation solidify its position in the market, giving it invaluable insights into emerging trends within the semiconductor industry.

Over the next five years, TSMC’s management anticipates its AI-related revenue to grow at an impressive 45% compound annual growth rate (CAGR). Even with its size, TSMC projects a revenue CAGR approaching 20%, a testament to the massive demand for its services. To meet this demand, TSMC has committed an additional $100 billion, supplementing the $65 billion already earmarked, to expand its manufacturing facilities in the U.S. With existing U.S. production facilities already fully booked through 2027, it’s clear that the U.S. is quickly becoming a prime location for new factories.

ASML: Powering Advanced Chip Manufacturing

The expansion of TSMC also greatly benefits ASML, the maker of the advanced machinery essential for high-end chip fabrication. ASML’s extreme ultraviolet (EUV) lithography machines are used to create the microscopic electrical circuits on chips. Given that nobody else holds this technology, ASML effectively has a technological monopoly. Thus, expansion announcements from TSMC translate directly into opportunities for ASML.

Nvidia and Broadcom: The Visionaries

Nvidia and Broadcom are significant customers of TSMC and play a major role in the projected surge in AI-related revenue growth. Nvidia produces graphics processing units (GPUs) that are exceptionally well-suited for computationally demanding tasks like AI training. Nvidia maintains a strong presence in this market, and shows no signs of slowing down.

Broadcom has developed similar AI accelerators known as XPUs, which are built to outperform GPUs in specific workloads, depending on how the workload is set up. This makes them vital for AI model development, though perhaps less versatile in some other workloads. Despite the competition, the market is large enough that both firms can thrive.

All four of these companies are currently backed by strong tailwinds, which suggests that the AI movement will not encounter major disruption anytime soon, making these companies a solid long-term investment opportunity. The current market offers an opportunity to buy these stocks at a good price.

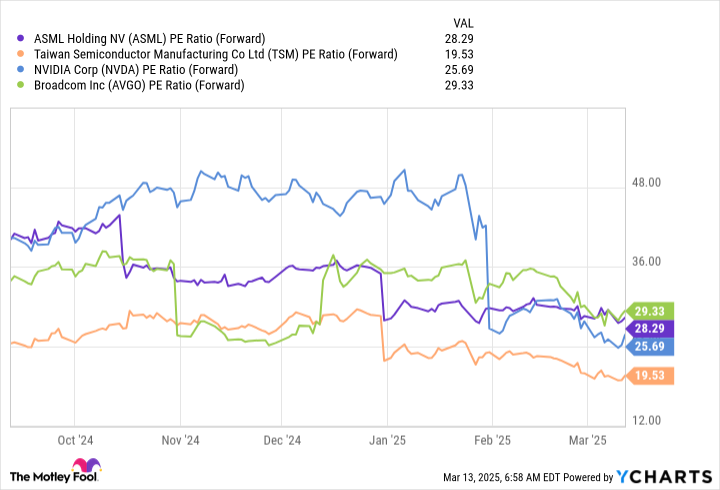

Evaluating Value: Forward Price-to-Earnings Ratio

Given the rapid growth of these companies, the forward price-to-earnings (P/E) ratio is a key metric for valuation.

TSMC seems the most undervalued, trading at less than 20 times forward earnings, an attractive bargain. If I were to pick one stock of this group, it would undoubtedly be TSMC. Nonetheless, ASML, Nvidia, and Broadcom also seem much cheaper than last year, making them investment-worthy.

While these companies might experience some short-term volatility, I envision a future where they are significantly more valuable than they are currently. I’m currently leveraging the present market weakness to establish positions in these leading AI stocks at what I believe are advantageous prices.