Shanghai Guao Electronic Technology’s Stock Rebounds, But Is It a Buy?

Investors in Shanghai Guao Electronic Technology Co., Ltd. (SZSE:300551) have seen a welcome 36% increase in the stock price over the last month. This rebound might offer some relief after the stock’s recent downturn, but it’s crucial to determine if this price surge is sustainable.

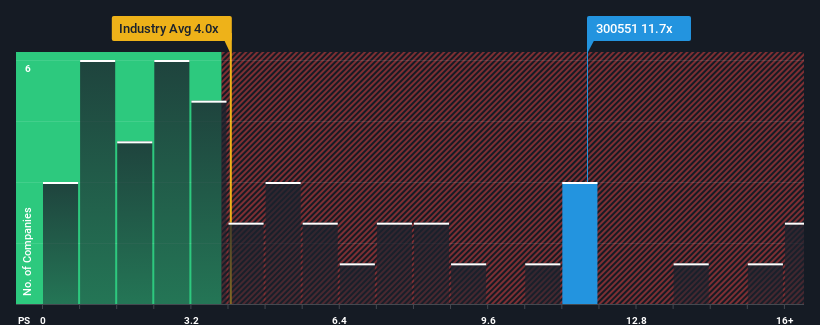

Despite the recent gain, the stock is still down 19% over the past year, a disappointing return for shareholders. The company’s price-to-sales (P/S) ratio currently stands at 11.7x. This appears high compared to other companies in China’s tech sector, where P/S ratios are often below 4x, and even below 2x. This raises the question: Is this high valuation justified, or is it a sign of potential overvaluation?

Performance Review: Revenue Trends

One key factor to consider is the company’s revenue performance. Over the past year, Shanghai Guao Electronic Technology has experienced revenue deterioration, a concerning trend. This makes the high P/S multiple even more perplexing. However, a potential explanation lies with investor expectations; perhaps the market anticipates strong future performance despite recent setbacks.

While specific analyst forecasts are unavailable, scrutinizing the company’s earnings, revenue, and cash flow is crucial to understanding its future trajectory. You can review a free report to understand the company’s position more fully.

P/S Ratio in Context: Growth Metrics

To justify its elevated P/S ratio, Shanghai Guao Electronic Technology would need to demonstrate exceptional growth, exceeding that of its industry peers. Comparing its recent performance to industry forecasts informs the market’s sentiment.

Over the last year, the company’s top line decreased by 43%. However, looking at the past three years, the company demonstrated an overall 35% rise in revenue. Compared to the industry’s predicted 22% growth over the next 12 months, Shanghai Guao Electronic Technology’s medium-term performance reveals weaker momentum. This paints a clear picture of relative underperformance.

Considering these figures, the company’s P/S ratio exceeding that of its industry peers is a cause for concern. The high P/S suggests that investors are either overlooking the company’s constrained growth or betting on a significant turnaround in its business prospects. If recent growth trends continue, current shareholders could face future disappointment, and potential investors might overpay.

Conclusion: Is the Stock Overvalued?

Shanghai Guao Electronic Technology’s P/S ratio has benefited from the recent share price increase. However, the company’s revenue performance is a cause for concern. Its three-year revenue trends are worse than industry expectations and may struggle to support the current positive market sentiment.

The current high P/S ratio is not supported by recent revenue performance, which could expose shareholders’ investments and risk potential investors paying a premium. Investors should also be aware of any potential risks. For instance, there are 2 warning signs for Shanghai Guao Electronic Technology (1 is potentially serious) that should be considered.

Investors should assess the long-term viability of the company and consider if its growth will justify its current valuation.

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice.