Shenzhen Ampron Technology’s Stock Surge: Is It Justified?

Shenzhen Ampron Technology (SZSE:301413) has recently experienced a significant surge in its stock price, gaining 67% in the past three months. This performance warrants a closer look at the company’s underlying financial health to determine if this momentum is sustainable. This article provides an analysis of the company’s key financial indicators to assess their role in the recent price movement.

Analyzing Return on Equity (ROE)

One crucial factor for investors is return on equity (ROE), which reveals how effectively a company reinvests its shareholders’ capital. It essentially shows how successful a company is at converting investments into profits.

How to Calculate Return on Equity

The formula for ROE is straightforward:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

Based on the trailing twelve months up to September 2024, Shenzhen Ampron Technology’s ROE is calculated as follows:

6.8% = CN¥81m ÷ CN¥1.2b.

This means that for every CN¥1 of equity, the company generated CN¥0.07 in profit.

ROE and Earnings Growth: What’s the Connection?

ROE provides a measure of a company’s profit-generating ability. The extent to which a company retains and efficiently reinvests these profits helps in assessing its potential for earnings growth. Generally, companies with a high ROE and strong profit retention tend to experience higher growth rates than those without these characteristics.

Shenzhen Ampron Technology’s ROE and Earnings Growth Compared

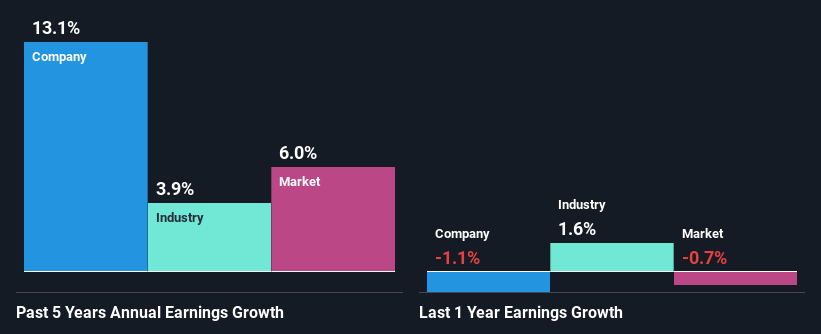

Shenzhen Ampron Technology’s ROE of 6.8% might initially appear modest. However, it’s comparable to the industry average of 6.1%. Furthermore, the company has demonstrated a respectable 13% growth in net income. This moderate ROE suggests there may be other factors positively influencing the company’s earnings.

It’s possible that management’s strategic decisions or a low payout ratio are contributing to this growth. Significantly, Shenzhen Ampron Technology’s net income growth surpasses the industry average of 3.9% during the same period, which is a positive sign.

Effective Use of Retained Earnings

The company has a three-year median payout ratio of 26%, retaining 74% of its profits. This indicates that its dividend payments are well-covered, and coupled with its decent growth, suggests efficient reinvestment of earnings. The recent introduction of dividends may be an effort to attract new and existing shareholders.

Conclusion

In conclusion, Shenzhen Ampron Technology presents some attractive aspects. Despite its moderate ROE, the company’s high profit reinvestment rate has likely contributed to its strong earnings growth. Further risk assessment is needed to make a more informed decision regarding the company’s future prospects.