Shenzhen Edadoc Technology’s Price Jump: A Red Flag?

The Shenzhen Edadoc Technology Co.,Ltd. (SZSE:301366) share price has experienced a significant surge recently, but is this a sign of strength or a potential bubble?

Over the past month, the stock has seen an impressive gain of 55%, and the past year shows an even more remarkable increase of 172%. This rapid rise raises questions about the company’s valuation.

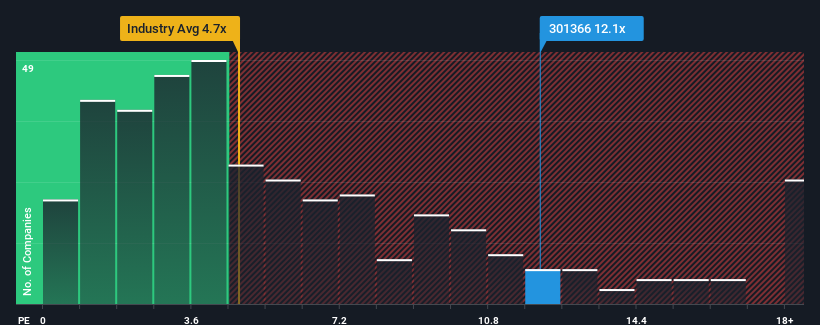

With the price increase, Shenzhen Edadoc Technology Ltd’s price-to-sales (P/S) ratio now stands at 12.1x. This figure appears high when compared to the Electronic industry in China: almost half of the companies in the sector have P/S ratios below 4.7x, and even P/S ratios under 2x are not uncommon. A high P/S ratio could suggest that investors have very high expectations regarding the company’s future performance. Analysis is needed to determine if the current valuation is justified.

Revenue Growth and Industry Comparison

Shenzhen Edadoc Technology Ltd. has shown solid revenue growth recently, a positive indicator. The market may be factoring in expectations that the company’s revenue will outperform its peers. It is critical to examine whether these expectations are realistic.

Last year, the company managed an 8.0% increase in revenues. Furthermore, over the last three years, the company produced a total revenue growth of 19%. However, the broader industry is projected to grow by 26% in the coming year, significantly higher than the company’s recent growth rates. Given these trends, the company’s high P/S relative to its industry peers is a potential area of concern.

Investor Sentiment and Future Outlook

The company seems to have investors who are highly optimistic about its future. However, if the revenue doesn’t continue to perform strongly, the stock price may be at risk. The sustainability of recent revenue trends will likely influence the share price.

The Bottom Line

While Shenzhen Edadoc Technology Ltd. shares have seen an upward trend, the high P/S ratio compared to its industry peers warrants caution. If the company’s revenue growth does not align with the optimistic valuation, there’s a considerable risk of a share price decrease and a corresponding fall in the P/S ratio.

Investors must analyze these factors carefully.

Slower-than-industry revenue growth combined with a high P/S ratio suggests a significant risk of the share price decreasing.

It is vital to consider the company’s business fundamentals and consider any warning signs. Investors should conduct thorough research and analysis before making investment decisions.