Shenzhen Kaizhong Precision Technology: Retail Investors and Insiders Benefit from Market Cap Increase

Shenzhen Kaizhong Precision Technology Co., Ltd. (SZSE:002823) experienced a CN¥424 million increase in its market capitalization last week, benefiting both retail investors and company insiders.

Key Insights:

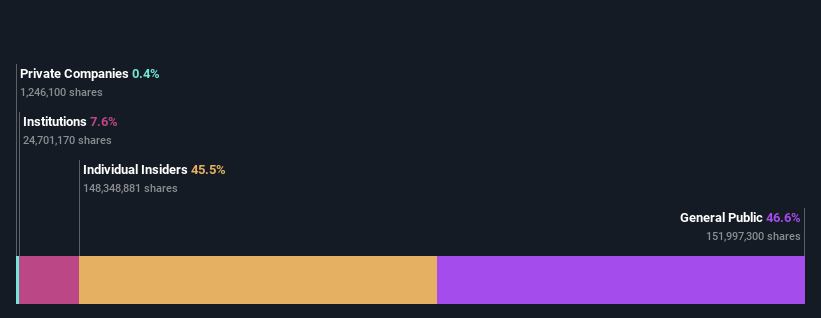

- A substantial 47% ownership stake by retail investors suggests they have significant influence on management and corporate governance.

- The top nine shareholders control 50% of the company’s shares.

- Insiders hold 45% of Shenzhen Kaizhong Precision Technology.

Retail investors, who collectively own approximately 47% of the company’s shares, saw the most gains. This significant ownership stake indicates that retail investors, as a group, have considerable potential to influence the company’s direction and decisions. Insiders, who hold a considerable 45% stake, also benefited from the market cap increase. The market cap reached CN¥5.4 billion last week.

To understand the control dynamics, it’s crucial to examine the shareholder structure.

Institutional Ownership

Institutional investors, who often benchmark their returns against market indexes, commonly invest in larger companies included within those indexes.

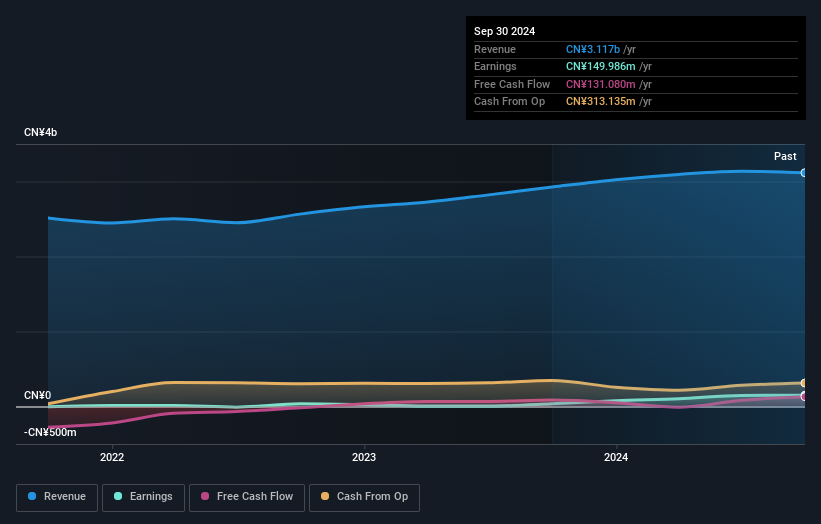

Shenzhen Kaizhong Precision Technology’s institutional ownership suggests a degree of credibility among professional investors. However, relying solely on this factor is insufficient, as institutions, like any investor, can make mistakes. Rapid shifts in the views of multiple institutions may lead to a sudden drop in the share price. Therefore, examining the company’s earnings history is essential.

Shenzhen Kaizhong Precision Technology is not owned by hedge funds.

Ownership Breakdown

The CEO, Hao Yu Zhang, is the largest shareholder, holding a 24% stake. The second- and third-largest shareholders hold 20% and 2.5% of the outstanding shares, respectively. Moreover, the top nine shareholders account for more than half of the share registry, with smaller shareholders likely balancing the interests of larger ones to some extent.

Insider Ownership

Company insiders, including board members, are expected to represent shareholder interests. Significant insider ownership can indicate strong alignment between the board and other shareholders. However, too much concentration of power within this group could be a concern.

Insiders own a large portion of Shenzhen Kaizhong Precision Technology Co., Ltd., holding CN¥2.5 billion worth of shares. This level of insider investment is a positive sign.

General Public Ownership

The general public, including retail investors, holds a 47% stake in the company.

While significant, this level of ownership might not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

While shareholder composition is important, other factors are critical for investment decisions. Investors should also be aware of potential risks associated with Shenzhen Kaizhong Precision Technology before investing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.