Shenzhen Techwinsemi Technology (SZSE:001309) Could Be Poised for Growth

Shenzhen Techwinsemi Technology Co., Ltd. (SZSE:001309) has recently caught the attention of investors, experiencing a significant price increase in the past few weeks. Despite not having the largest market capitalization, the company has outperformed many others on the Shenzhen Stock Exchange (SZSE).

Financial analysts have not yet fully covered the stock, which presents an opportunity for potential investors. This analysis will delve into the valuation and outlook of Shenzhen Techwinsemi Technology to assess its investment potential.

Valuation and Opportunity

Based on a price multiple model, Shenzhen Techwinsemi Technology appears to be trading at a relatively low price compared to its industry peers. The company’s price-to-earnings ratio currently stands at 41.1x, significantly below the industry average of 65.9x. Because cash flows aren’t yet predictable, the price-to-earnings ratio offers the clearest picture.

While the stock’s volatility could lead to price fluctuations, this may provide future buying opportunities. This volatility is indicated by a high beta value.

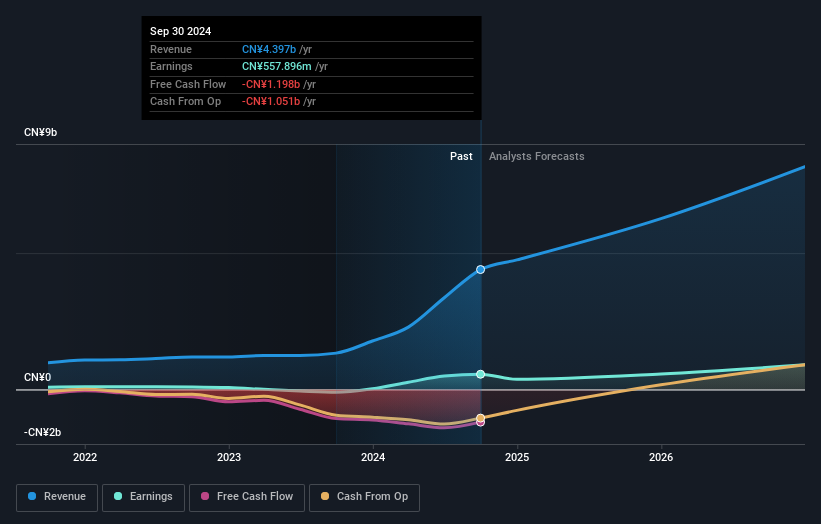

Growth Projections

Investors seeking portfolio growth should consider Shenzhen Techwinsemi Technology’s prospects. With a projected profit growth of 46% over the next few years, the company’s financial future looks promising. This growth should translate into a higher share valuation.

Investment Considerations

For Current Shareholders

Since the stock is currently trading below the industry average price-to-earnings ratio, it is a good time to consider adding to your holdings of Shenzhen Techwinsemi Technology. This potential growth has not yet been completely factored into the current share price. However, investors must be considering capital structure and other financial metrics to make the right choice.

For Potential Investors

For those who have been monitoring SZSE:001309, now might be an opportune time to buy shares. The company’s promising future profit outlook isn’t fully reflected in the current share price. However, investors should also make a well-informed assessment of the risks the firm may be facing, considering the company’s management team and overall financial health.

If you’d like to learn more about Shenzhen Techwinsemi Technology, it’s important to understand potential risks. The company has several warning signs that investors should be aware of.

Disclaimer: This article is based on historical data and analyst forecasts. It does not constitute financial advice.